Unlock Ethereum: How It Works and Why It’s Valuable

Ethereum is the second-largest cryptocurrency by market capitalization and one of the most actively used blockchains worldwide. Unlike Bitcoin, Ethereum is more than a digital currency—it serves as a decentralized computing platform. It introduced smart contracts, enabling the creation of various decentralized applications (DApps) and Web3 technologies. Let’s explore Ethereum’s key features, its history, and its applications.

Article Highlights

🔗Ethereum is a decentralized platform that executes smart contracts, which are computer programs coded to operate on its blockchain.

🔗Smart contracts enable developers to create decentralized applications (DApps), including crypto exchanges (Uniswap, Sushiswap) and lending platforms (Compound, AAVE).

🔗Ether (ETH) is Ethereum’s native cryptocurrency, used for transactions and as a gas fee for computations within the Ethereum ecosystem.

What Is Ethereum?

Ethereum is a decentralized computing platform that facilitates financial transactions without intermediaries, using blockchain technology. While Bitcoin’s blockchain primarily enables digital asset transfers, Ethereum offers broader functionalities, supporting the creation of custom applications via smart contracts. Smart contracts allow Ethereum to host diverse applications, such as decentralized exchanges, lending protocols, and stablecoins. This flexibility makes Ethereum a cornerstone of decentralized finance (DeFi).

The History of Ethereum

Ethereum was conceived in 2013 by Vitalik Buterin, a Russian-Canadian programmer. He proposed the concept in a document titled “Ethereum: The Ultimate Smart Contract and Decentralized Application Platform,” outlining his vision for a blockchain capable of running any application. Ethereum officially launched in 2015, establishing itself as a second-generation blockchain platform.

Ethereum vs. Bitcoin

Although Ethereum and Bitcoin share similarities as blockchain networks, they differ significantly:

- Bitcoin: A first-generation blockchain focused on secure, peer-to-peer digital asset transfers. Its programming is intentionally limited for security purposes.

- Ethereum: A second-generation blockchain with advanced programmability. Its smart contract capabilities allow for the development of decentralized applications (DApps) beyond simple transactions.

- Both networks use cryptography to secure transactions, but Ethereum’s flexibility has made it the foundation for innovations like DeFi and Web3.

What Are Smart Contracts?

Smart contracts are self-executing programs stored on the Ethereum blockchain. These contracts automatically perform actions—such as transferring tokens—when specified conditions are met. Unlike traditional programs, smart contracts reside permanently on the blockchain, making them immutable and accessible to anyone. One popular use case is the creation of ERC-20 tokens, the most common token standard on Ethereum. For example, when a user sends ERC-20 tokens, the smart contract updates the token balances of the sender and receiver, ensuring transparency and accuracy.

Applications of Smart Contracts

Ethereum’s smart contract technology enables various use cases, including:

Stablecoins

Stablecoins solve cryptocurrency volatility by pegging their value to assets like the US dollar or other fiat currencies. Examples include:

- USD Coin (USDC): Pegged to the US dollar.

- RupiahToken (IDRT): An Ethereum-based stablecoin equivalent to the Indonesian Rupiah. Stablecoins combine the stability of traditional currencies with the speed and security of blockchain transactions.

Lending and Borrowing

Decentralized lending platforms like Compound and AAVE use Ethereum smart contracts to facilitate borrowing and lending without banks. Users can earn interest by depositing crypto or borrow assets against collateral.

Decentralized Exchanges (DEXs)

DEXs like Uniswap and Sushiswap leverage Ethereum’s smart contracts to enable token swaps without centralized intermediaries. These platforms allow users to trade Ethereum-based tokens directly from their wallets.

What Is Ether (ETH)?

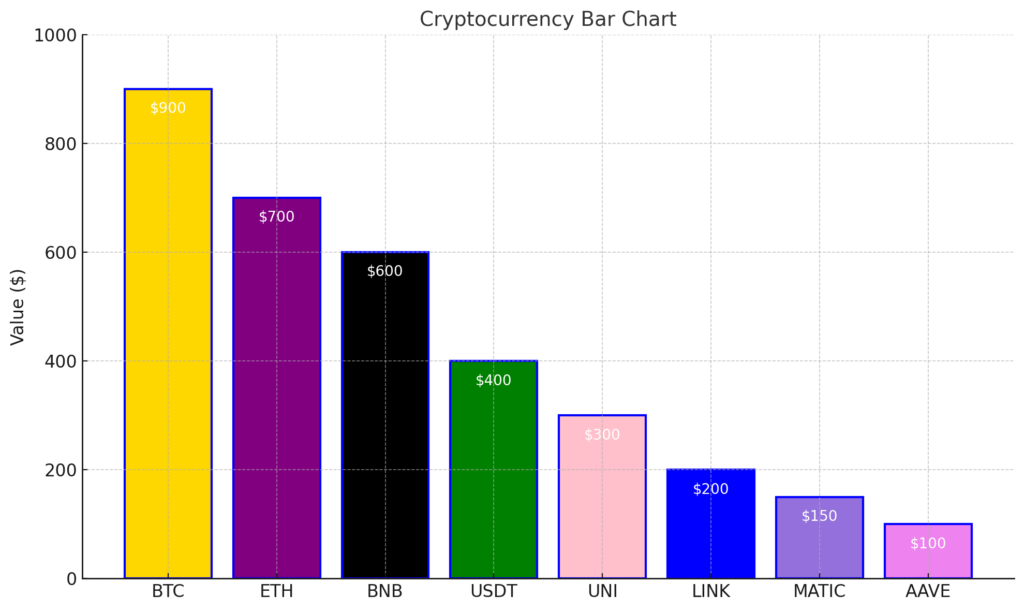

Ethereum’s blockchain is one of the oldest and busiest in existence. Ether, used as a gas fee, has become one of the largest cryptocurrencies by market value after Bitcoin. If you’ve read about what Ethereum is, you might still wonder how it differs from Ether or ETH. Ether is the native coin of the Ethereum blockchain, primarily used to facilitate transactions within its ecosystem.

Every transaction in the Ethereum ecosystem incurs a computational cost, known as a gas fee, which is paid to miners who process the transactions. These fees are paid using Ether. The more complex the computation required, the higher the gas fee. For instance, sending ERC-20 tokens incurs higher fees than sending ETH. This is because transferring ERC-20 tokens involves smart contract interactions and computations, whereas sending ETH does not.

What Makes Ether (ETH) Valuable?

ETH can be used as digital money or to carry out various transactions on the Ethereum blockchain. Ethereum is one of the most widely used blockchains for developing decentralized applications (dApps) because it allows for more diverse programming compared to Bitcoin. With its role as a gas fee for computing tasks on applications built on Ethereum, ETH has become the second-largest cryptocurrency by market value, following Bitcoin.

How To Buy ETH?

After gaining a deeper understanding of what Ethereum is, if you’re interested in owning ETH, you can purchase it through a crypto exchange like Safubit. For more updates about cryptocurrency follow our social media:

X: https://x.com/safubit

Medium : https://medium.com/@safubit.exchange

Learn more about cryptocurrency in Safubit Academy.

January 14, 2025

January 14, 2025