Bull vs. Bear Markets: Characteristics and How to Identify

In the financial markets, including stocks and cryptocurrencies, price trends follow recurring patterns of rises and falls. These patterns are referred to as bull and bear markets, signaling dominant price movements over a specific period. Investors and traders use these trends as vital indicators to guide their decisions. This article explores the meaning of bull and bear markets, their significance in the crypto world, and how to identify these trends effectively.

Article Highlights

- 🐻 A bear market represents a prolonged price decline driven by negative sentiment and excess supply.

- 🐂 A bull market is marked by rising prices due to high demand and positive market confidence.

- 🗒️ Recognizing trend changes early allows investors to make strategic decisions and prepare for market shifts.

What is a Bear Market?

A bear market occurs when supply exceeds demand, leading to declining prices and negative sentiment. During this period, investors often lose confidence in the market, triggering widespread selling. In the crypto market, a bear trend is typically defined by a decline of 20% or more in Bitcoin’s price from its all-time high (ATH).

Bear markets can be particularly challenging for beginners, as the significant price drops may result in impulsive decisions and substantial losses. Altcoins, being more volatile than Bitcoin, often experience even steeper declines during these periods.

What is a Bull Market?

A bull market, in contrast, is a period of rising prices fueled by high demand and investor confidence. This upward trend often leads Bitcoin and other cryptocurrencies to reach new ATHs.

The crypto community generally displays optimism and enthusiasm during a bull market. Altcoins often rally alongside Bitcoin, creating opportunities for investors to profit significantly. Developers also seize the momentum to launch projects, attracting retail investors eager to participate.

Why Do Bull and Bear Markets Occur?

All financial markets, including crypto, experience cycles of ups and downs. These cycles reflect shifts in investor sentiment, market dynamics, and broader economic conditions. While stock markets typically undergo longer cycles due to their maturity, the younger crypto market is characterized by shorter, more volatile cycles.

For instance:

- Economic factors: Global events like inflation, interest rate changes, and economic policies influence market trends.

- Political developments: Government stances on crypto, such as bans or adoption, play a crucial role. Positive actions, like El Salvador adopting Bitcoin, can fuel bull markets, while restrictive measures, like China’s crackdown, may trigger bear trends.

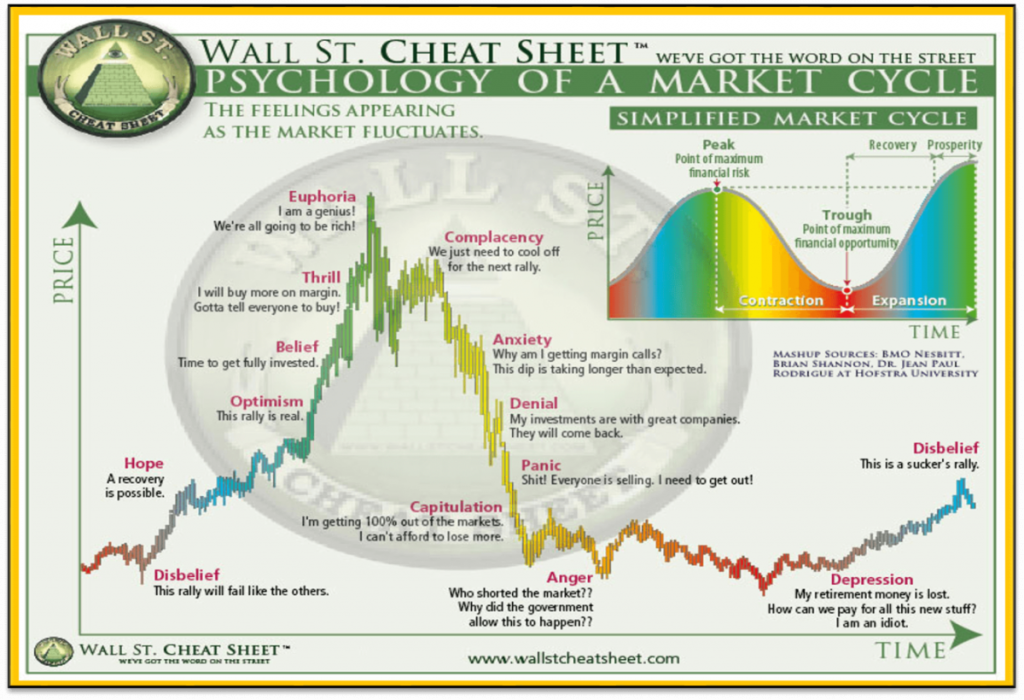

Market Sentiment and Cycles

Investor sentiment significantly impacts crypto price movements. The psychological stages of a market cycle—hope, euphoria, fear, and despair—help illustrate how emotions influence trends:

- Bull markets: Begin with optimism and peak during euphoria.

- Bear markets: Start with denial and extend into despair before stabilizing.

Understanding these cycles helps investors anticipate market changes and align their strategies accordingly.

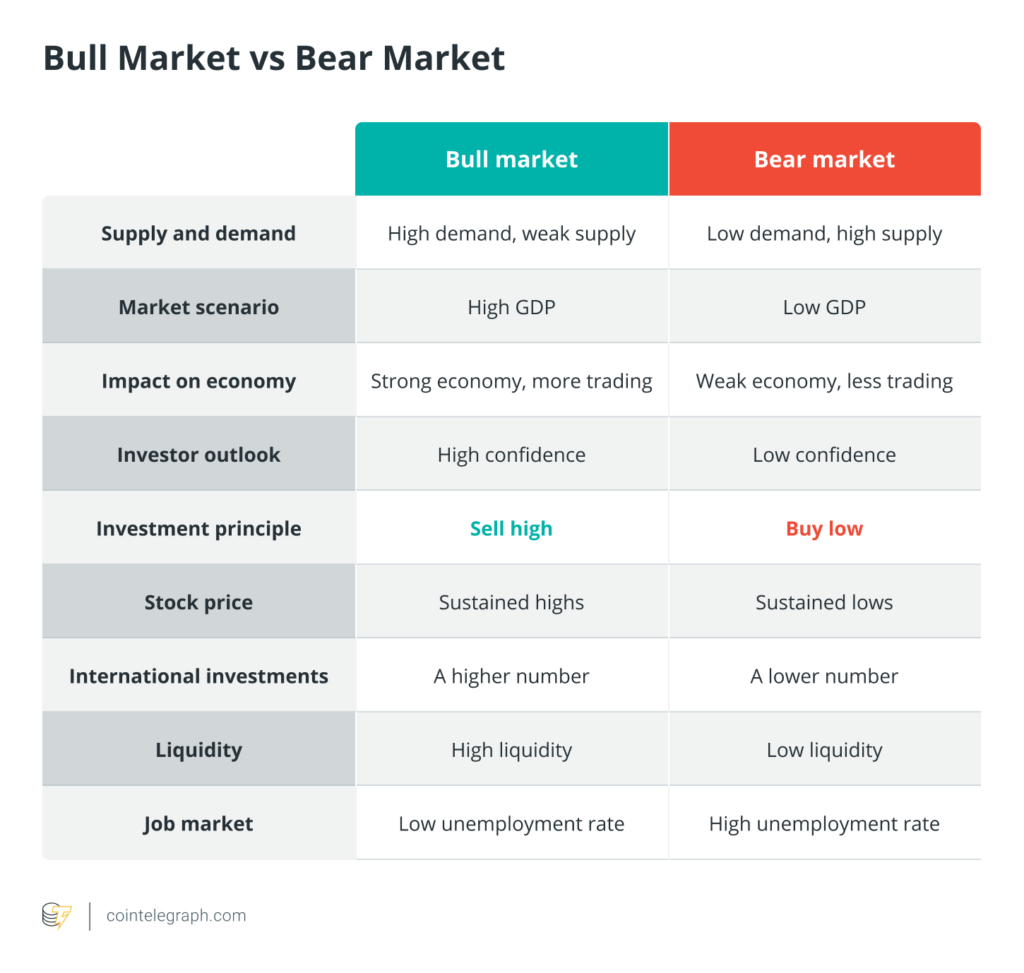

Indicators of Bull and Bear Markets

While market trends don’t shift suddenly, certain indicators can signal the beginning of a bull or bear market:

1. Liquidity

- Bull markets: High trading volumes and asset exchanges lead to increased liquidity.

- Bear markets: Investors hold back, resulting in reduced liquidity and lower trading activity.

2. Community Sentiment

- Bull markets: Marked by optimism, HODLing behavior, and success stories.

- Bear markets: Dominated by panic selling, pessimism, and widespread losses.

3. Golden Cross and Death Cross

- Golden Cross: Occurs when the 50-day moving average (MA) crosses above the 200-day MA, signaling a shift to a bull market.

- Death Cross: The opposite scenario, where the 50-day MA falls below the 200-day MA, indicates a transition to a bear market.

Strategies for Bull and Bear Markets

Understanding market trends is crucial for effective investing. Here are strategies tailored for each market condition:

In Bear Markets

- ⚠️ Move to Stablecoins: Convert assets to stablecoins like USDT to protect against losses.

- 🛍️ Buy the Dip: Use bear markets as opportunities to purchase assets at discounted prices.

In Bull Markets

- 🤑 Take Profits: Gradually secure gains to hedge against potential reversals.

- 💹 Leverage Trading Opportunities: Combine technical and fundamental analysis to identify high-potential assets.

Conclusion

Bull and bear markets are fundamental components of the crypto market, shaping investor behavior and price trends. By understanding these cycles and utilizing key indicators, investors can navigate market fluctuations effectively. Whether you’re buying during dips or capitalizing on gains, recognizing market trends is essential for achieving long-term success in crypto investments.

Learn more knowledge of crypto through various articles on Safubit Academy. All articles on Safubit Academy are created for educational and informational purposes only and are not intended as financial advice.

Don’t forget to follow our social media:

X : https://x.com/safubit

Medium : https://medium.com/@safubit.exchange

January 21, 2025

January 21, 2025