Mastering Crypto Fundamentals: A Guide to Analysis

Investors and traders have long sought effective ways to identify assets with significant profit potential, employing techniques like analyzing price trends, company performance, and market conditions. In the world of cryptocurrency, Fundamental Analysis (FA) has emerged as an essential tool to evaluate crypto assets. Drawing parallels to its application in traditional financial markets, FA helps investors determine the intrinsic value of a crypto asset and its role within the market. This guide delves into the principles and methods of conducting fundamental analysis in the cryptocurrency landscape.

Article Highlights

💸 Fundamental Analysis (FA) involves evaluating an asset’s intrinsic value through economic, technological, and managerial factors.

⚖️ FA offers insights into the true potential of crypto projects, helping investors distinguish between genuine opportunities and scams.

🔎 Key FA components include assessing the whitepaper, analyzing tokenomics, understanding the team, and conducting on-chain analysis.

Understanding Fundamental Analysis (FA)

Fundamental Analysis assesses the intrinsic value of an asset relative to its current market position. In traditional finance, FA examines a company’s balance sheet, management structure, and macroeconomic factors. In the crypto world, FA evaluates the purpose, technology, team, and tokenomics of a crypto project.

By identifying the “real” value of a crypto asset, investors can determine if a project is undervalued (market cap below its fundamental value) or overvalued (market cap inflated despite weak fundamentals). This process is crucial for informed decision-making and mitigating risks in a volatile market.

Why is Fundamental Analysis Important in Crypto?

Distinguishing Genuine Projects: FA enables investors to discern between credible projects and scams by assessing aspects like the team, whitepaper, and technology.

Assessing Market Potential: FA provides insights into whether a project has untapped potential or if its current valuation reflects its true worth.

Reducing Risk: By thoroughly evaluating crypto assets, investors can make data-driven decisions and minimize exposure to fraudulent or overhyped projects.

How to Conduct Fundamental Analysis in Crypto

Analyzing the Whitepaper

The whitepaper serves as the blueprint of a crypto project, outlining its purpose, technology, and roadmap.

A credible whitepaper should be:

- Free from grammatical errors and ambiguities.

- Detailed in explaining the problem the project solves, its target market, and the team behind it.

- Clear and systematic.

Key Questions to Ask:

- What problem does the project aim to solve?

- How user-friendly and scalable is the technology?

- Does the roadmap outline clear milestones and timelines?

- What is the token distribution between investors and the public?

Researching the Team

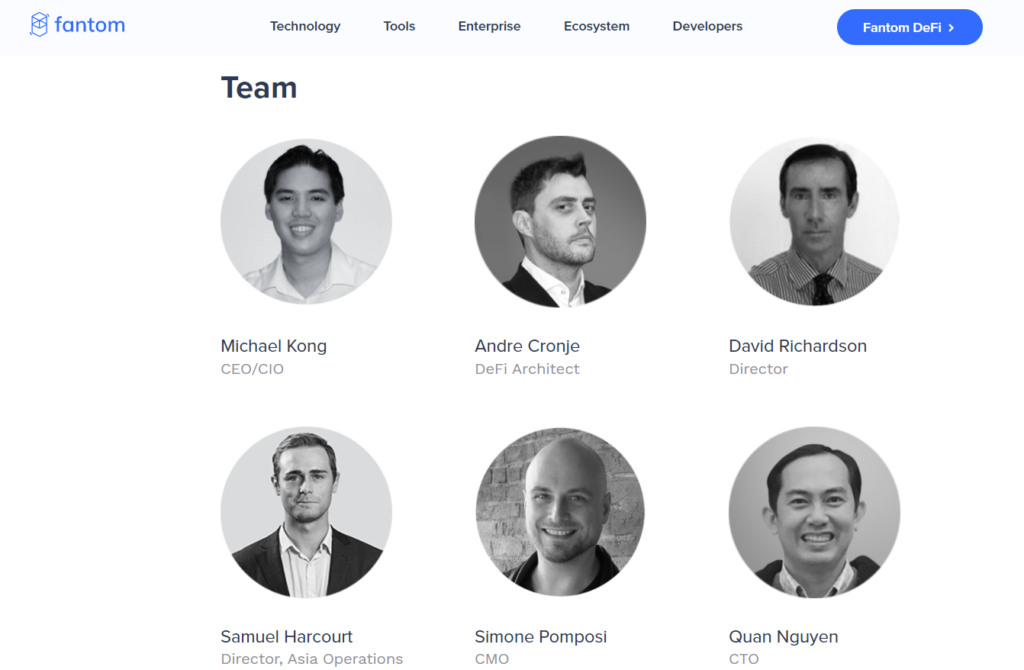

Example : Fantom Foundation Team Page

The team behind a crypto project significantly influences its credibility and potential success. Investigate the team’s background, expertise, and track record for red flags like involvement in previous scams.

Red Flags:

- Anonymous team members with no public identity.

- Lack of expertise or a history of fraud.

- Limited or no community engagement.

Evaluating Tokenomics

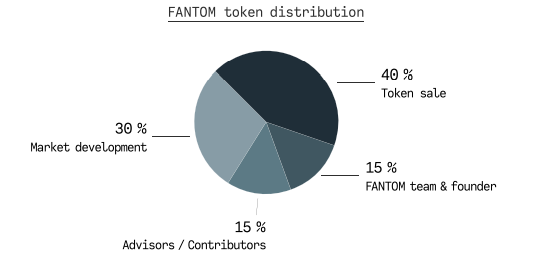

Example : The distribution of FTM tokens during the initial ICO can be found in the Fantom whitepaper.

Tokenomics refers to the economic model governing a crypto asset, including:

- Distribution: An ideal distribution favors public token allocation over team/investor holdings.

- Vesting Period: Gradual release of tokens over several years prevents sudden market sell-offs.

- Utility: Tokens should have a clear use case, such as governance, staking, or transaction fees.

Projects with imbalanced tokenomics or short vesting periods may lack long-term sustainability, posing risks to investors.

Conducting On-Chain Analysis

On-chain analysis evaluates blockchain activity to gauge a project’s real-world usage. Key metrics include:

- Active Addresses: Indicates user engagement.

- Transaction Volume: Reflects blockchain usage intensity.

- Staking Levels: Measures user commitment to the project.

Tools like CoinMetrics and Glassnode provide on-chain data for a deeper understanding of project performance.

Identifying Genuine vs. Fraudulent Projects

Red Flags of Fraudulent Projects:

- Absence of a whitepaper or poorly written documents.

- An anonymous or inexperienced team.

- Overly centralized token distribution favoring insiders.

- Lack of transparency and inactive social media.

Characteristics of Genuine Projects:

- Well-documented, transparent whitepaper and roadmap.

- Experienced, credible team with public profiles.

- Balanced tokenomics supporting long-term growth.

- Strong, engaged community and regular project updates.

Conclusion

Conducting fundamental analysis is indispensable for making informed investment decisions in the crypto market. By examining factors like whitepapers, tokenomics, and blockchain activity, investors can identify promising projects and avoid scams.

Learn more knowledge of crypto through various articles on Safubit Academy. All articles on Safubit Academy are created for educational and informational purposes only and are not intended as financial advice.

Don’t forget to follow our social media:

X : https://x.com/safubit

Medium : https://medium.com/@safubit.exchange

January 21, 2025

January 21, 2025