How to Effectively Use DeFi Applications

Decentralized finance (DeFi) projects grew rapidly in 2020, a period known as DeFi Summer. During this time, several DeFi applications emerged, offering new financial services as alternatives to traditional financial systems. In this article, we will explain how to use DeFi applications easily. Don’t worry, you don’t need to be a professional crypto trader to use them. You just need to understand the basics of DeFi financial services. Let’s dive in.

Article Summary

- DeFi: A decentralized financial system that uses blockchain technology. Anyone can access DeFi without intermediaries like financial institutions or banks.

- Opportunities: DeFi offers users significant opportunities to make financial assets work productively to generate profits.

- Easy Use: Using DeFi applications is easy; just connect your crypto wallet like Metamask with the DApps you want to use.

Services: Current DeFi financial services include decentralized exchanges (DEX), savings and loans, staking, farming, crypto asset insurance, synthetic derivative trading, and more.

Overview of DeFi

DeFi stands for decentralized finance, a blockchain-based financial platform accessible to anyone without intermediaries such as financial institutions or banks.

In its operations, DeFi uses cryptocurrency, blockchain, and smart contracts. Smart contracts with specific algorithms regulate all activities in DeFi, such as token pricing, interest rates, service fees, transaction approvals, and other activities.

According to DeFiLlama, on November 15, 2022, the total value locked (TVL) in the DeFi ecosystem across various blockchains was USD 43.78 billion, significantly lower than the December 2021 TVL of USD 181.32 billion.

Why Use DeFi?

Essentially, DeFi facilitates existing financial services but offers transparency and significant opportunities for its users. Moreover, DeFi financial services are not controlled by any institution.

DeFi’s advantages over traditional financial systems include 24/7 access to financial services and fast transaction execution within minutes. Users can manage their own ‘money’ in crypto without being controlled by companies or financial institutions.

DeFi makes it easy for users to access financial services. Anyone can use DeFi through decentralized applications (DApps). To access DeFi financial products, users do not need to undergo KYC (Know Your Customer), unlike traditional financial systems that require personal data to open savings accounts or borrow funds, such as email, ID, tax number, photos, and other data.

How to Use DeFi Applications

Choose a Blockchain Network

As the pioneer blockchain with smart contracts, most DeFi activities run on the Ethereum blockchain. However, there are many other smart contract blockchains competing with Ethereum, such as Binance Smart Chain, Solana, Polygon, Fantom, and others.

Each blockchain has advantages like fast transaction processes, low gas fees, robust DeFi ecosystems, and more. Considering these factors, you can choose which DeFi application to use on which network. This article will explain how to use DeFi applications on the Ethereum network.

Create a Crypto Wallet

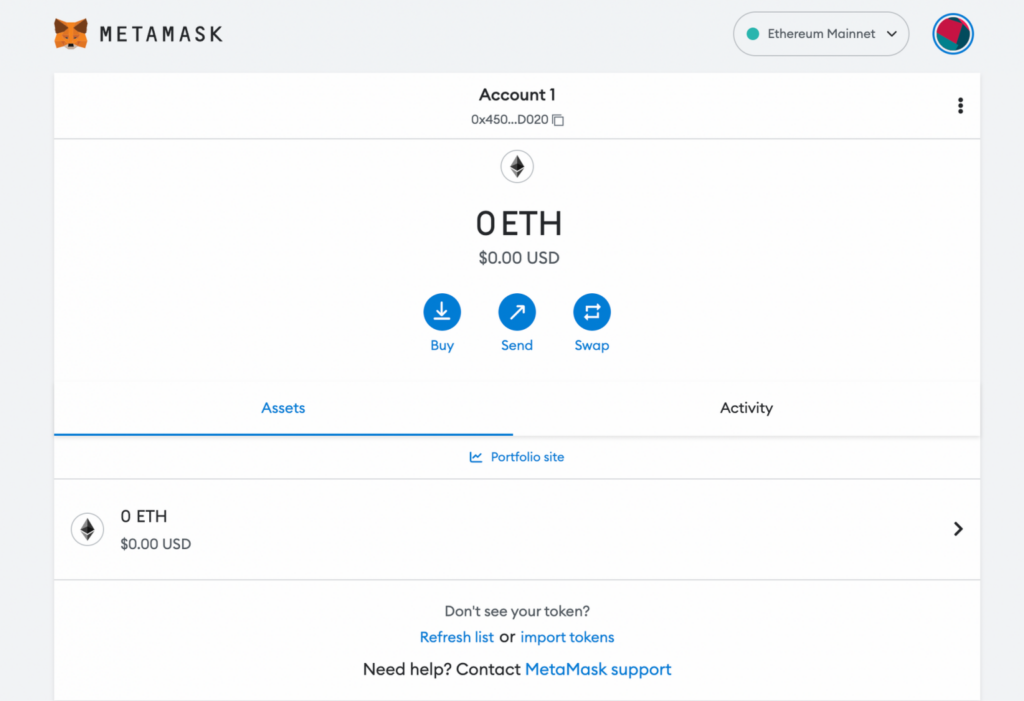

First, to access DeFi applications, users need to connect a crypto wallet like Metamask, Trustwallet, Phantom, or others. Metamask is one of Ethereum’s wallets that supports multiple blockchain networks and can be installed as a wallet extension in the user’s browser. Metamask provides safe and efficient access to DeFi.

A wallet extension installed in the browser makes it easy for users to access DeFi applications directly and manage their money in the browser. Here’s how to create a Metamask account.

Step 1

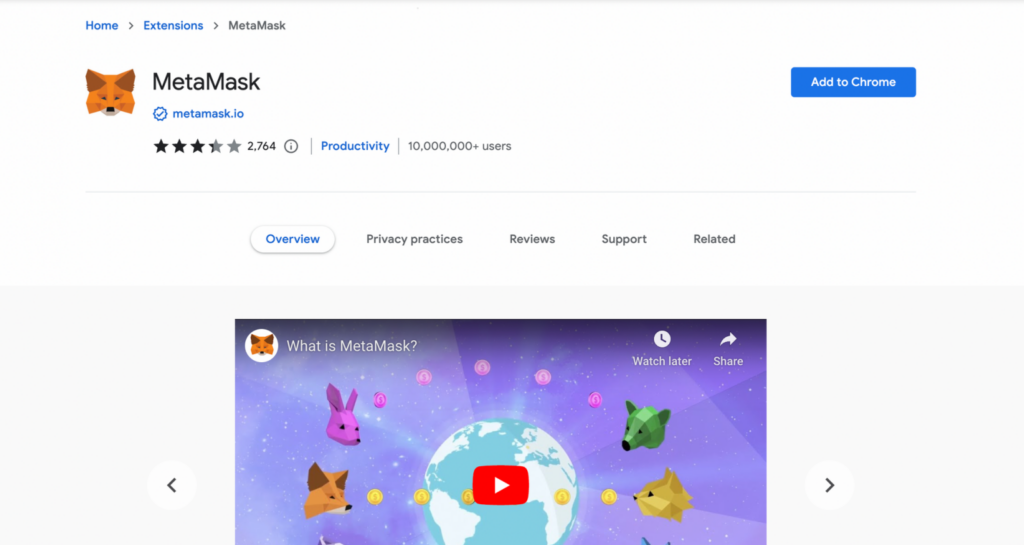

- Visit the Chrome Extension page.

- Type “Metamask” in the Search Extensions field.

- Click Add to Chrome.

Step 2

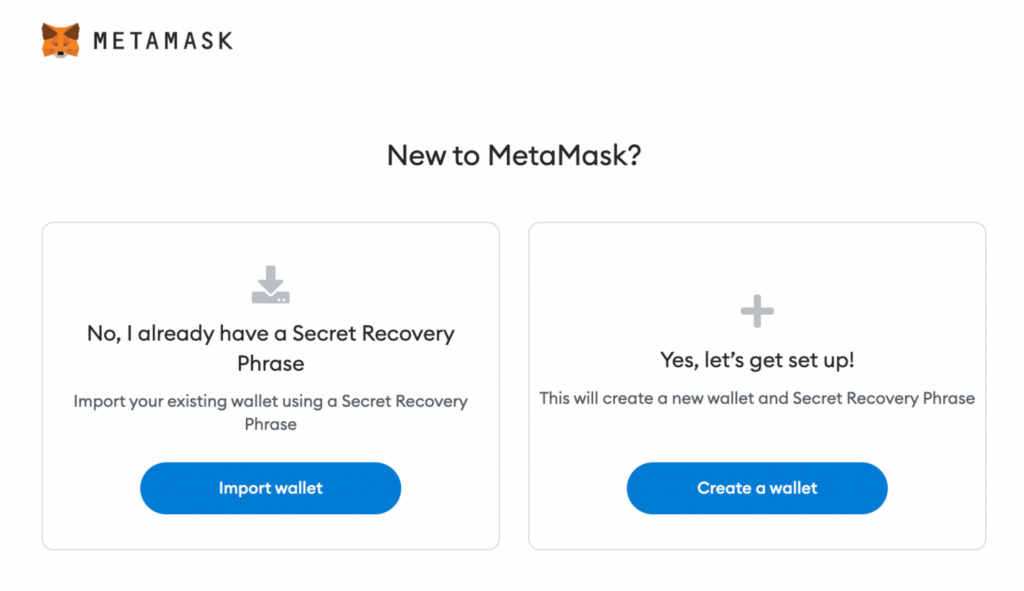

- Click Create a Wallet to create a wallet on the right side.

- Note: If you already have a Metamask wallet, you can click Import Wallet and enter the secret recovery phrase.

Step 3

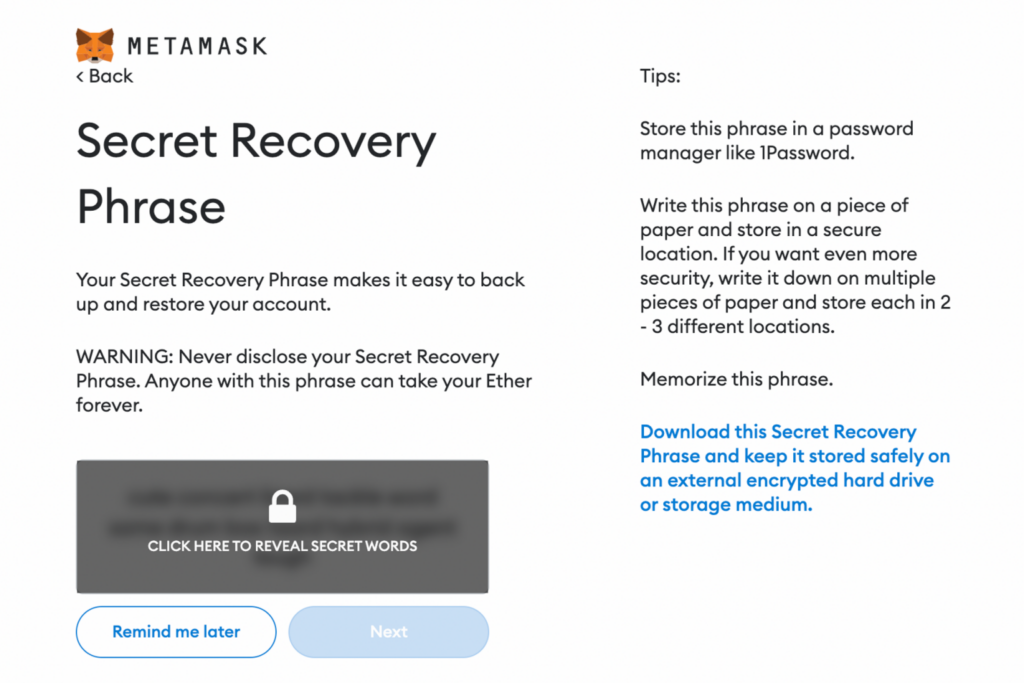

- Click the lock icon to reveal your secret recovery phrase.

- Note: This secret recovery phrase consists of 12 random words. Write these words in a notebook to avoid losing them. Never share your secret recovery phrase with anyone! Someone can access your wallet if they have it.

Step 4

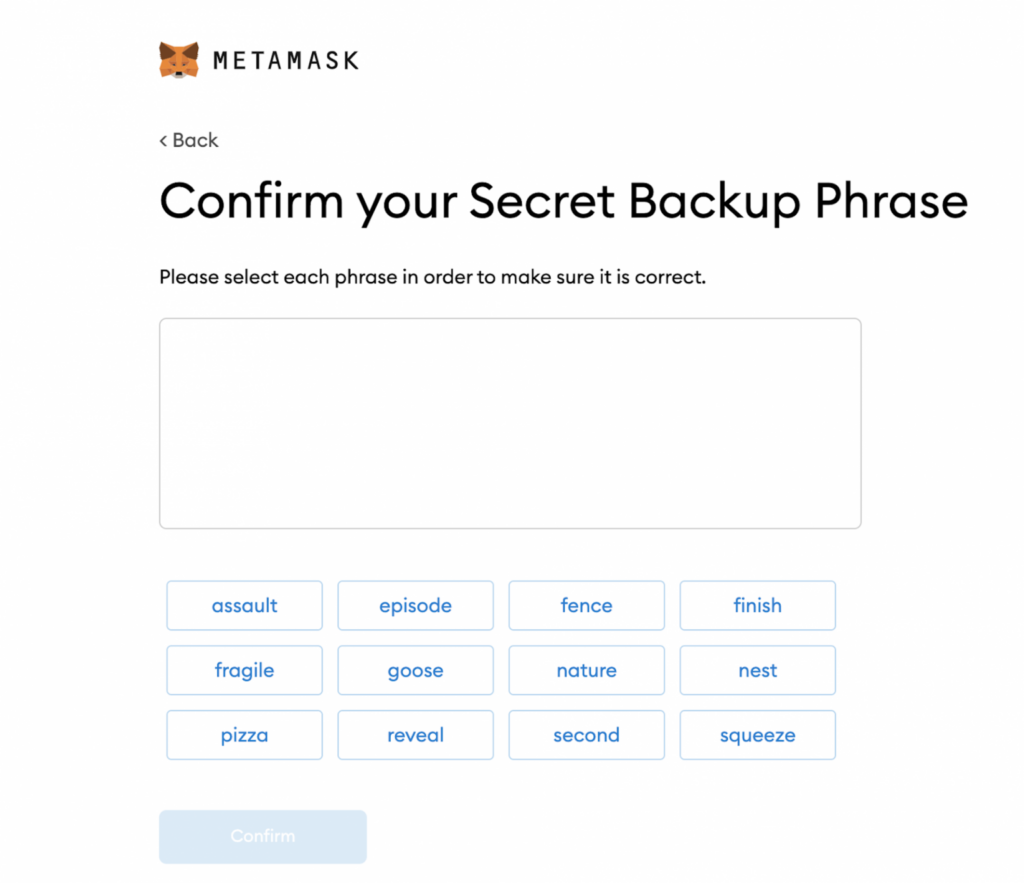

- Arrange the words you wrote down by clicking on them.

- Congratulations! You now have a Metamask wallet and can access DeFi applications in the Ethereum ecosystem. You can also download Metamask on your smartphone. Since you already have a secret recovery phrase, you can enter those words into the smartphone version of Metamask.

Buy Cryptocurrency

Before using decentralized applications, you need to have some of the main blockchain coins (e.g., ETH) or standard blockchain tokens (e.g., ERC-20 tokens) in your wallet.

Why do you need crypto assets in your wallet? The answer is that crypto is used to pay gas fees. To approve and execute transactions, DApps use smart contracts that run with gas fees. These gas fees are paid to validators who confirm transactions and secure the network.

Step 1

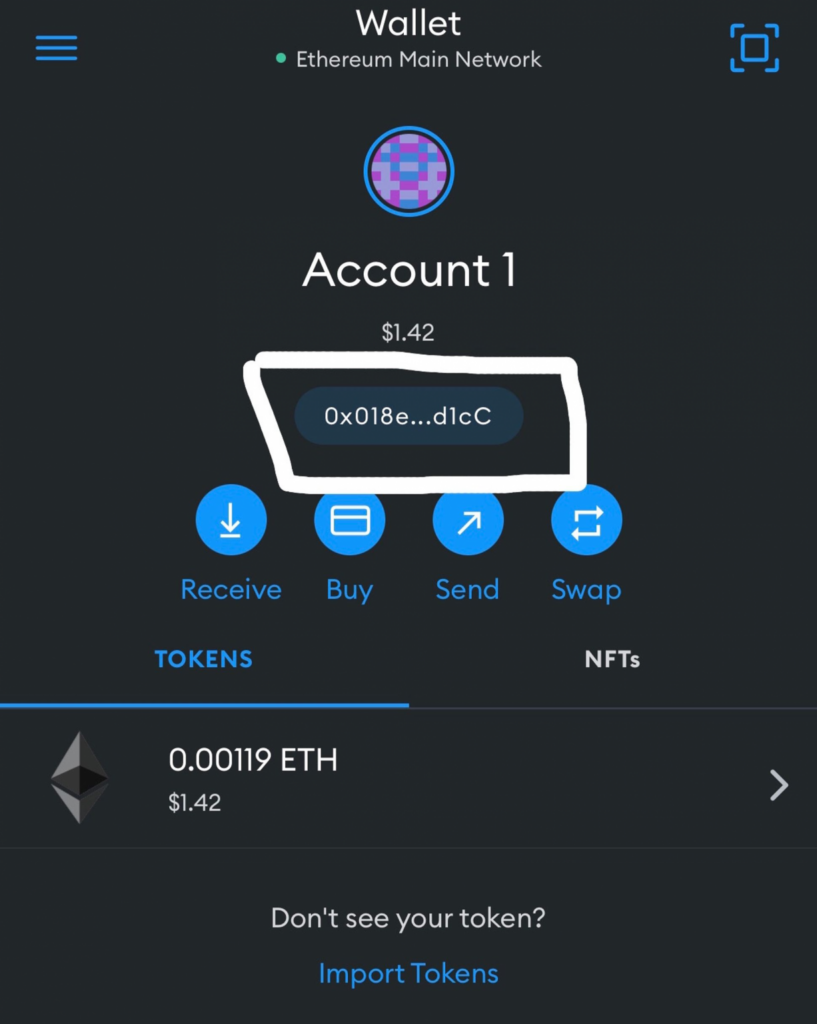

- Copy your Metamask wallet address.

- Note: Ensure your wallet address is correct without any errors in letters or numbers. If there are discrepancies, the crypto assets you send will not reach your wallet.

Step 2

- Log in to the app, then click Wallet.

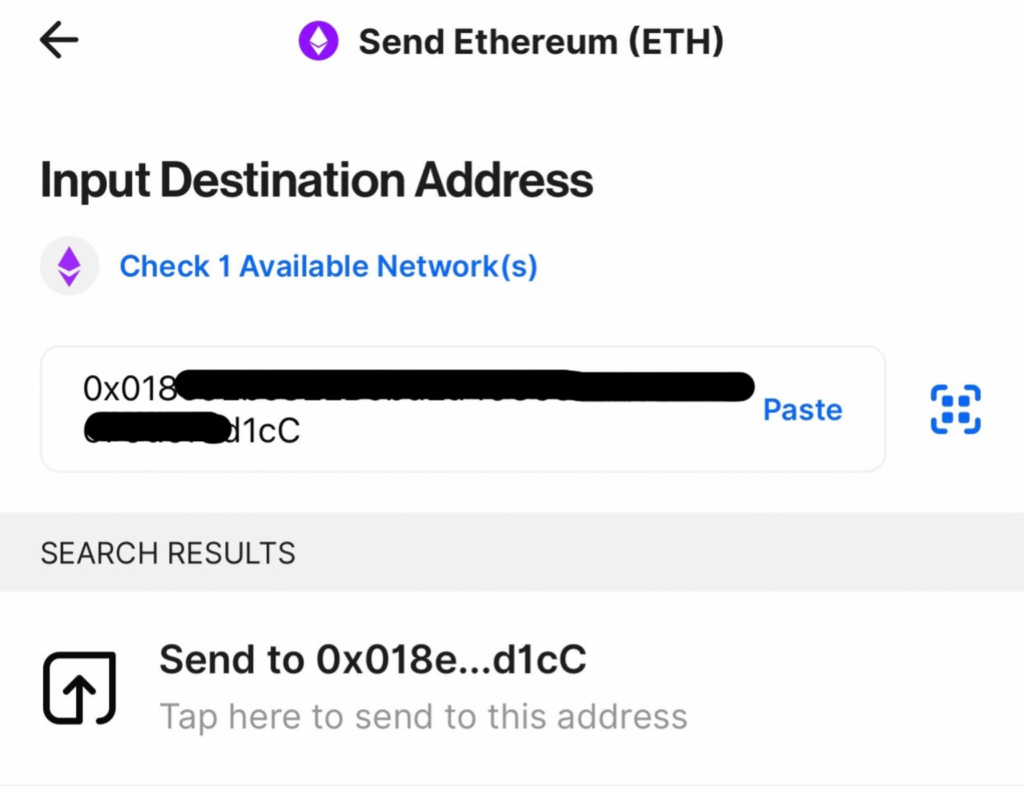

- Select Ethereum crypto, then click Send.

- Paste the Metamask address in the Wallet Address field, then click Send to.

- Note: If you send ETH, the network will automatically be the Ethereum network. Remember to check which network to use if sending other crypto assets.

Step 3

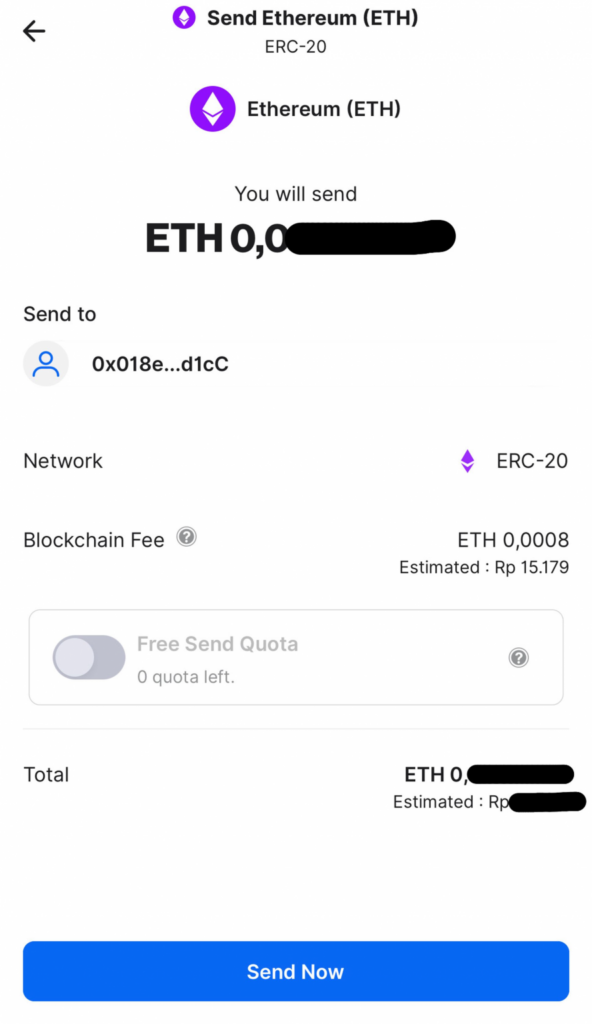

- Enter the amount of ETH you want to send.

- Click Next.

- Click Send Now.

- Enter your password.

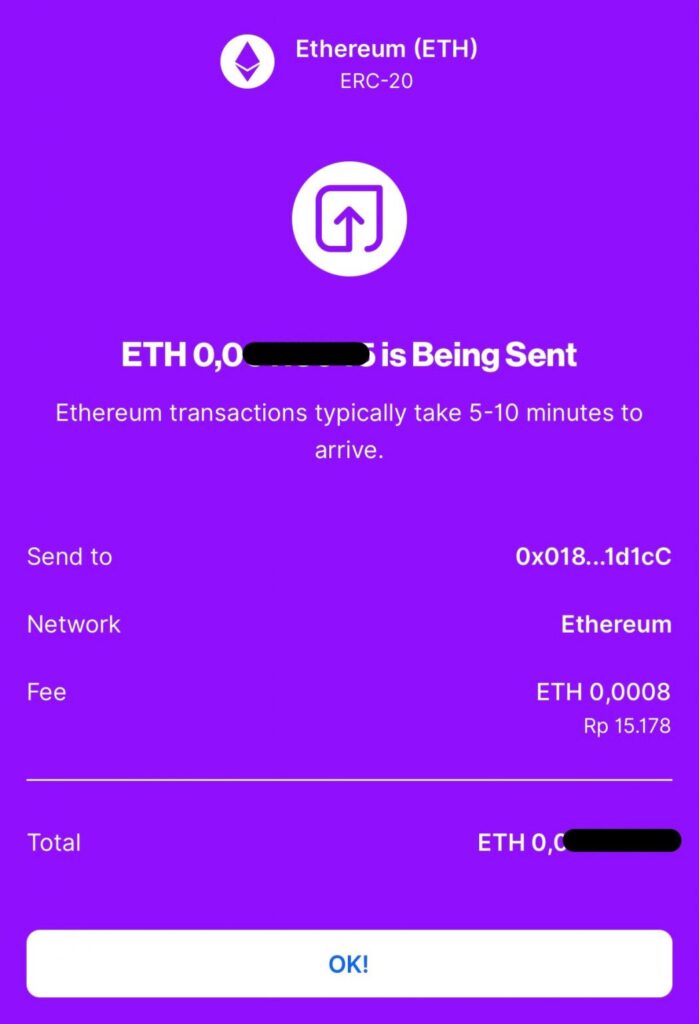

Step 4

- The transfer is complete. You can wait a few minutes to receive ETH in your Metamask.

- Click OK.

- Note: To send ETH on the Ethereum network (ERC-20), you will be charged a blockchain or gas fee.

Choose a DeFi Application (Decentralized Applications or DApps)

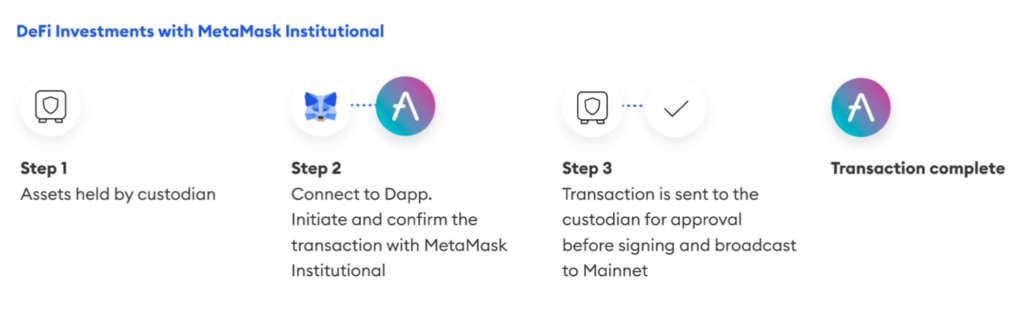

DeFi users usually aim to maximize the profits or interest earned by using several DeFi applications. To access all DeFi applications, you only need to connect your wallet to the DApps you want to use.

To access DeFi, users only need to connect their wallet. Source: Consensys Report 2022

Here are some DeFi financial services and DApps available today that you can use to earn profits and passive income from DeFi.

Decentralized Exchange (DEX)

Users can perform various financial activities on DEXs like exchanging crypto assets, becoming liquidity providers, staking, and more.

Users can utilize Yield Farming by becoming liquidity providers (LP) on DEXs. Being a liquidity provider is one way to profit from DeFi.

Users can deposit two equal amounts of crypto assets into a liquidity pool to get liquidity pool tokens. These tokens can then be deposited into the Farming pool to earn the main DEX tokens like UNI, SUSHI, CRV, etc. Besides getting the main tokens, users will also receive a portion of the transaction fees from the token transactions in that pool.

In addition to being liquidity providers, users can also use the Staking feature to earn passive income. In the staking feature, users can lock a certain number of tokens to receive rewards in other tokens.

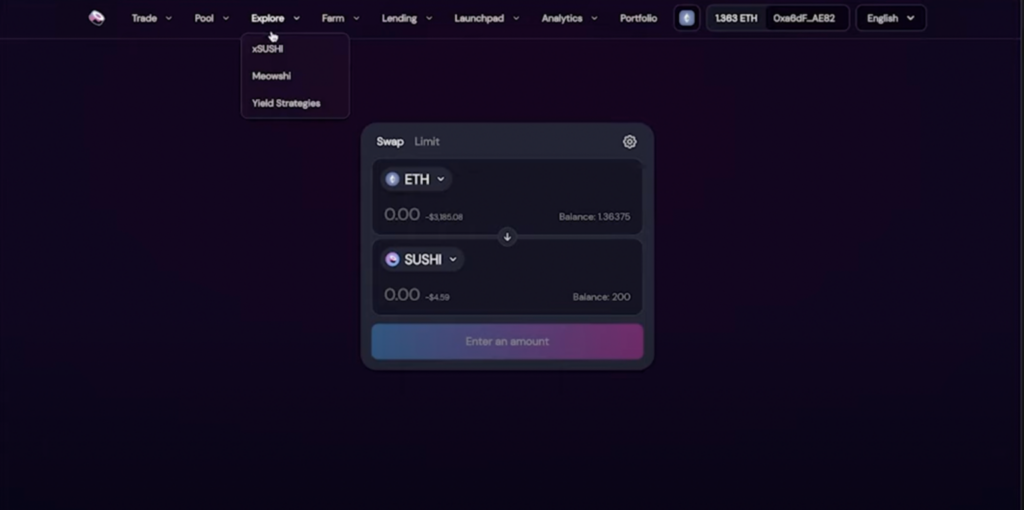

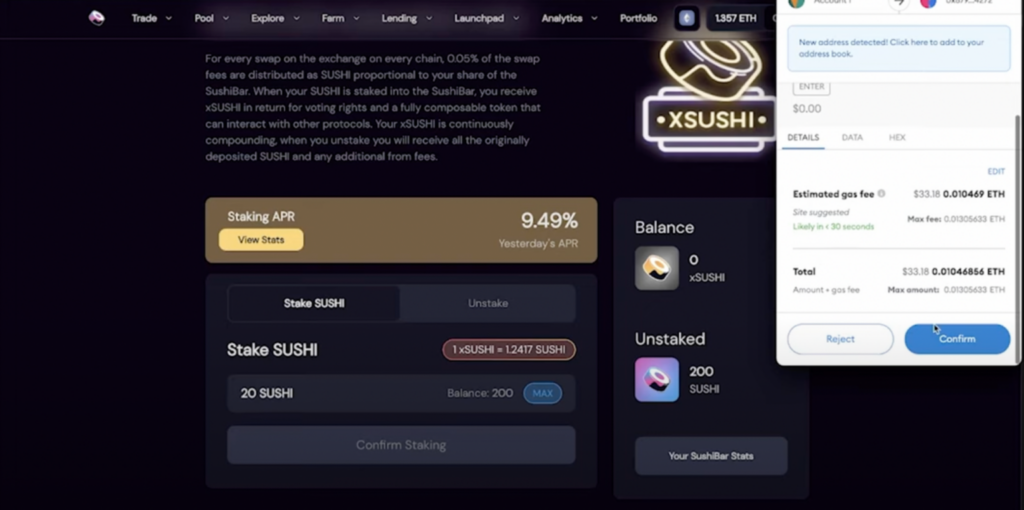

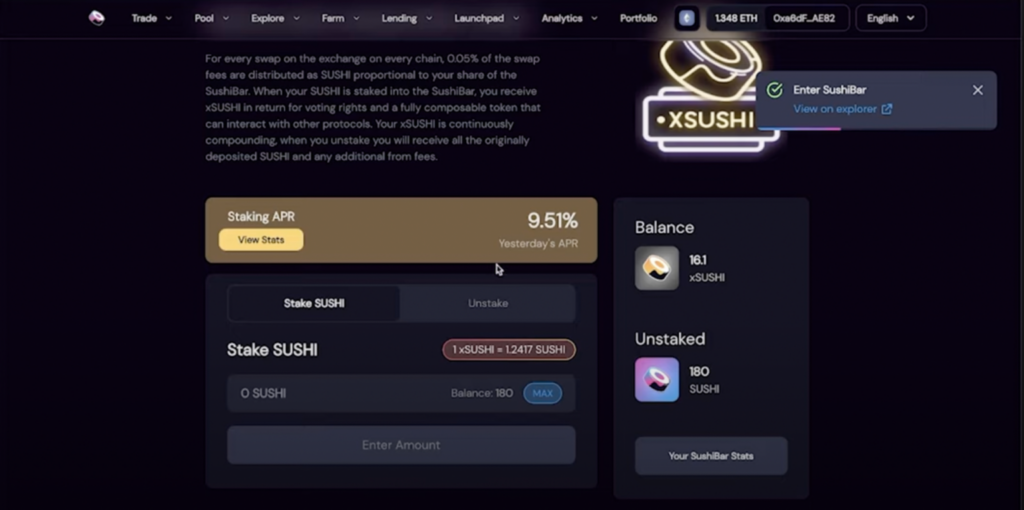

On Sushiswap, you can stake SUSHI tokens to get xSUSHI tokens. Here’s how to stake on Sushiswap.

Source: Hodl Yields

Step 1

- Visit Sushi.com, then connect your wallet.

- Select Explore, then xSUSHI.

Step 2

- Enter the amount of SUSHI tokens you want to stake to get xSUSHI tokens.

- For example, enter 20 SUSHI.

- Click Confirm Staking.

- The Metamask wallet will appear to confirm the transaction.

- Click Confirm.

Step 3

- Staking is successful!

- The xSUSHI amount increases to 16.1.

- The xSUSHI amount will increase daily so you can earn passive income by staking SUSHI.

Savings and Loans

Like bank deposit and loan services, DeFi also has savings and loan services in crypto assets. Users can deposit crypto assets into liquidity pools and receive varying interest rates.

Additionally, users can borrow crypto assets for leverage trading (trading with borrowed funds). This is done by depositing larger crypto assets as collateral than the assets to be borrowed. Each crypto asset has a different Loan to Value (LTV) percentage.

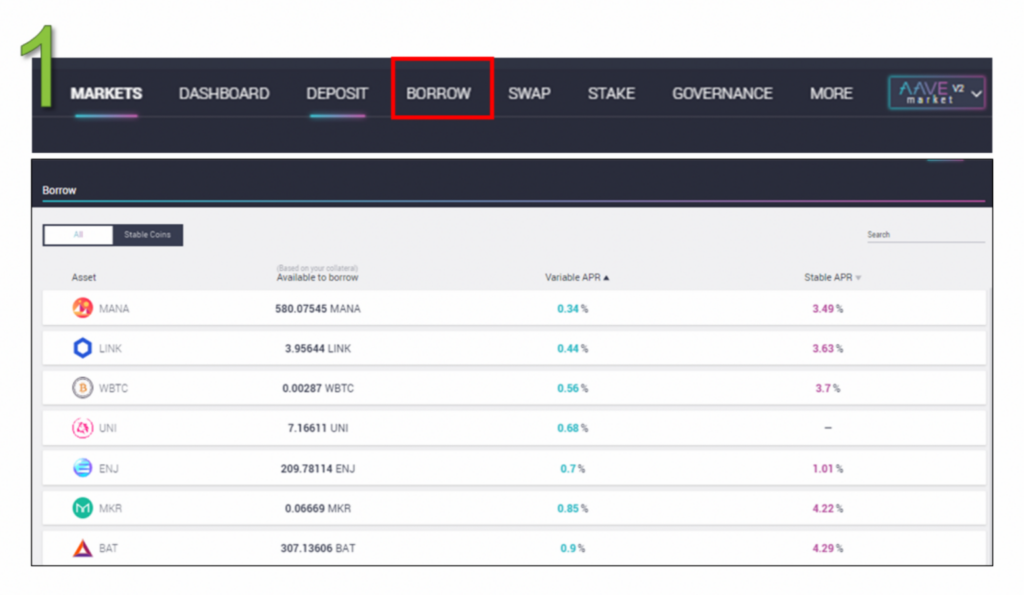

One DApp that offers savings and loan services on Ethereum is Aave. Here’s how to borrow crypto assets on the Aave platform.

Source: Coingecko

Step 1

- Visit the Aave website, then connect your wallet.

- Deposit assets (e.g., 100 DAI) by clicking Deposit, then complete the crypto asset deposit process.

- After successfully depositing 100 DAI, click Borrow.

- With 100 DAI, you will see various cryptos you can borrow and the interest rates.

Step 2

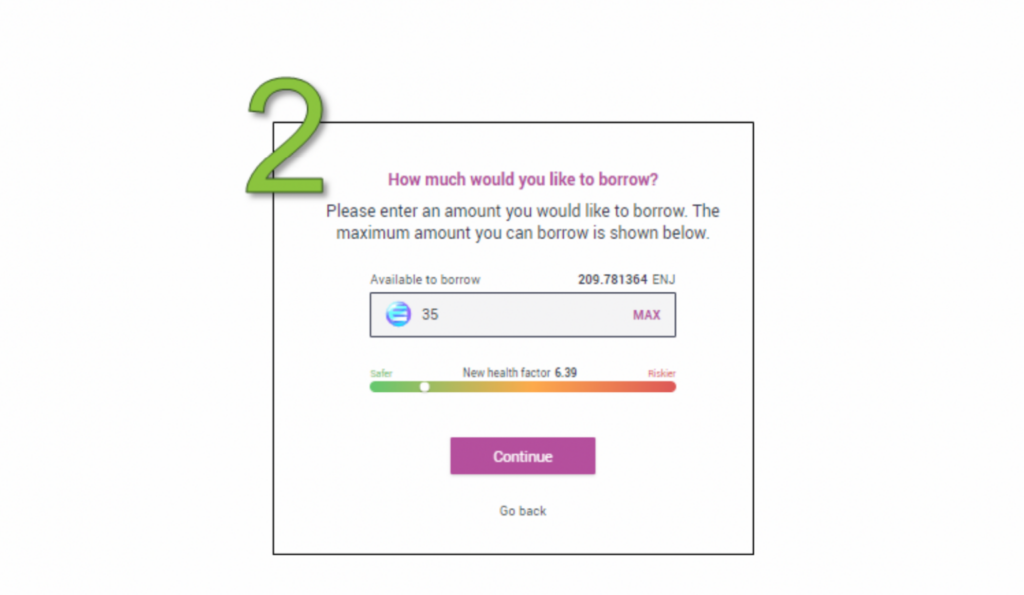

- For example, you choose ENJ crypto assets. With 100 DAI, you can borrow 209 ENJ. But you decide to borrow only 35 ENJ.

- Click Continue.

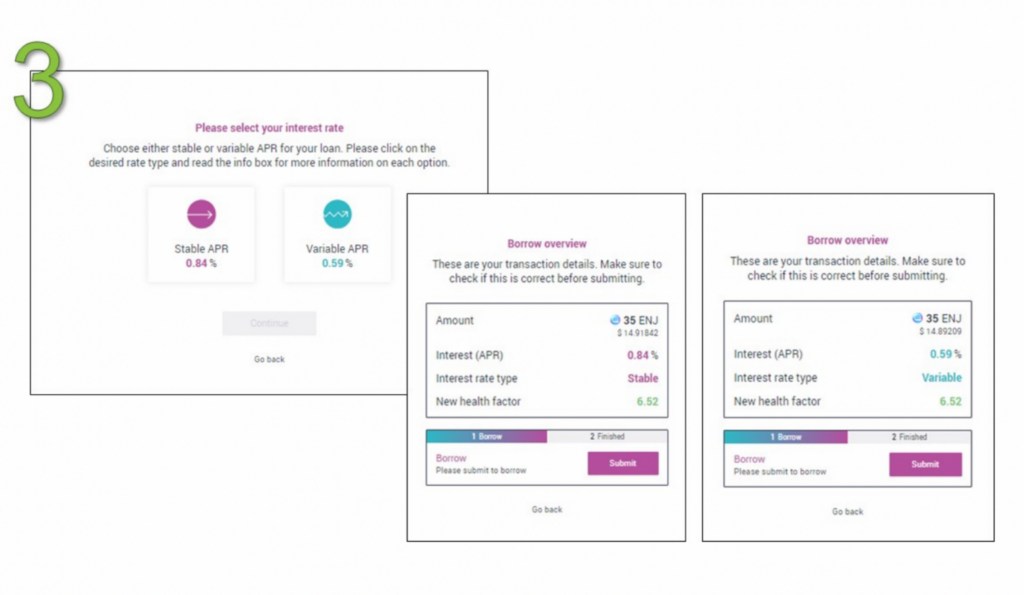

Step 3

- Choose the interest rate for this loan.

- There are two types of interest: stable interest and variable interest. With stable interest, you will be charged an annual rate (APR) of 5.81% for borrowing ENJ. The APR will remain stable.

- With variable interest, the annual interest (APR) is 5.79%. The APR is lower than stable interest but will fluctuate according to the market.

- You choose stable interest, so click Continue.

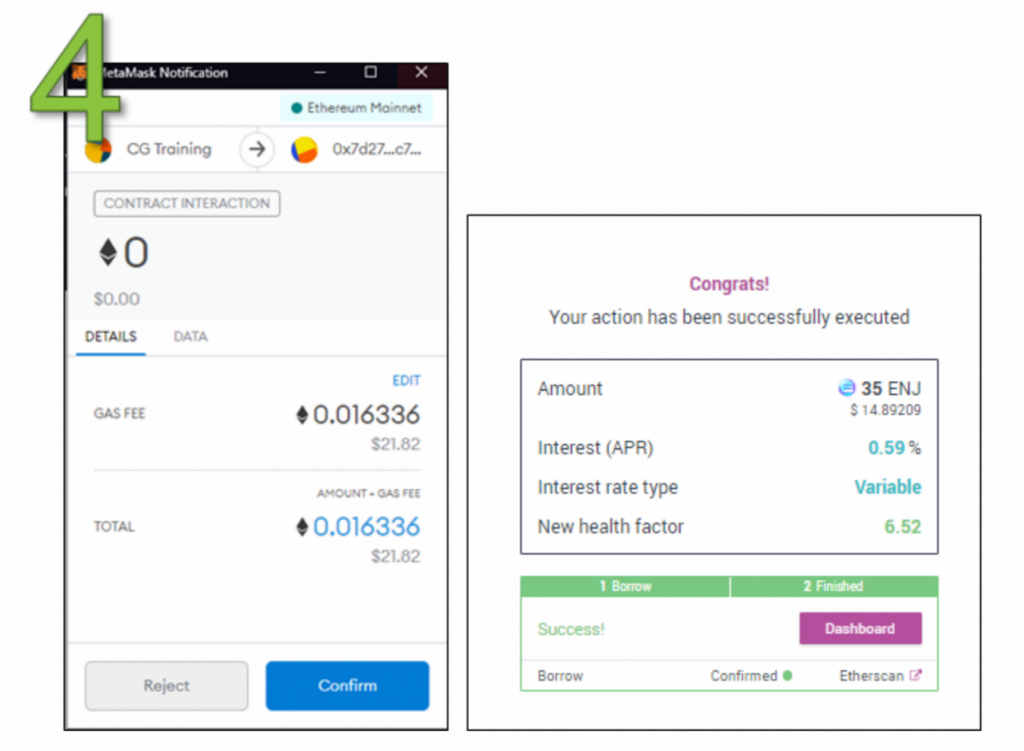

Step 4

- Approve the loan request by clicking Continue.

- Confirm the transaction through the Metamask wallet that appears.

- After the transaction is successful, you will receive 35 ENJ in your wallet.

Aggregator

An aggregator is a DeFi function that gathers price comparisons from various DEXs (Decentralized Exchanges). Its purpose is to provide the best prices to users who want to trade and select the lowest slippage.

To minimize slippage, users typically divide their large amounts of crypto assets into smaller portions and direct them to various DEXs to get the best prices. This process can be quite cumbersome.

With a DeFi aggregator, users can automatically split large amounts of crypto assets into smaller portions and then execute the best prices across multiple DEXs automatically.

Examples of aggregator DApps include 1Inch, Matcha, and Zapper.

Here’s an example of swapping crypto assets using the 1Inch aggregator:

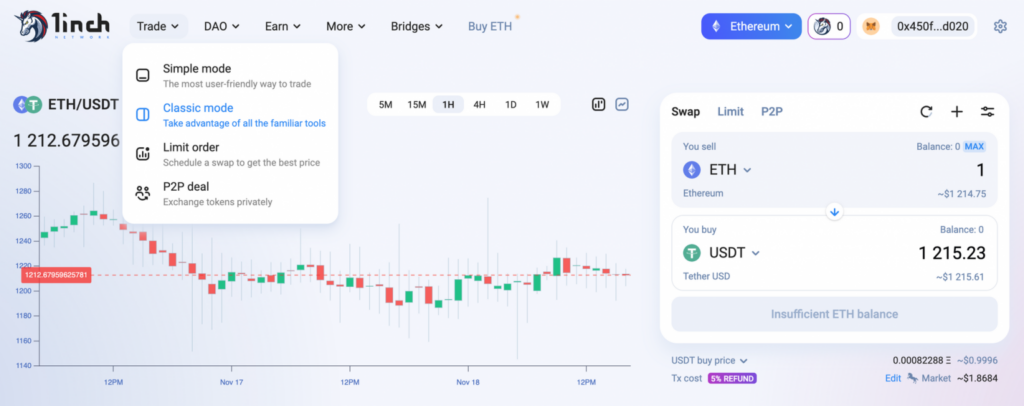

Step 1

Visit the 1Inch website and connect your wallet. Select the “Trade” menu and then click “Classic Mode.” In this example, let’s say you want to exchange ETH for USDT.

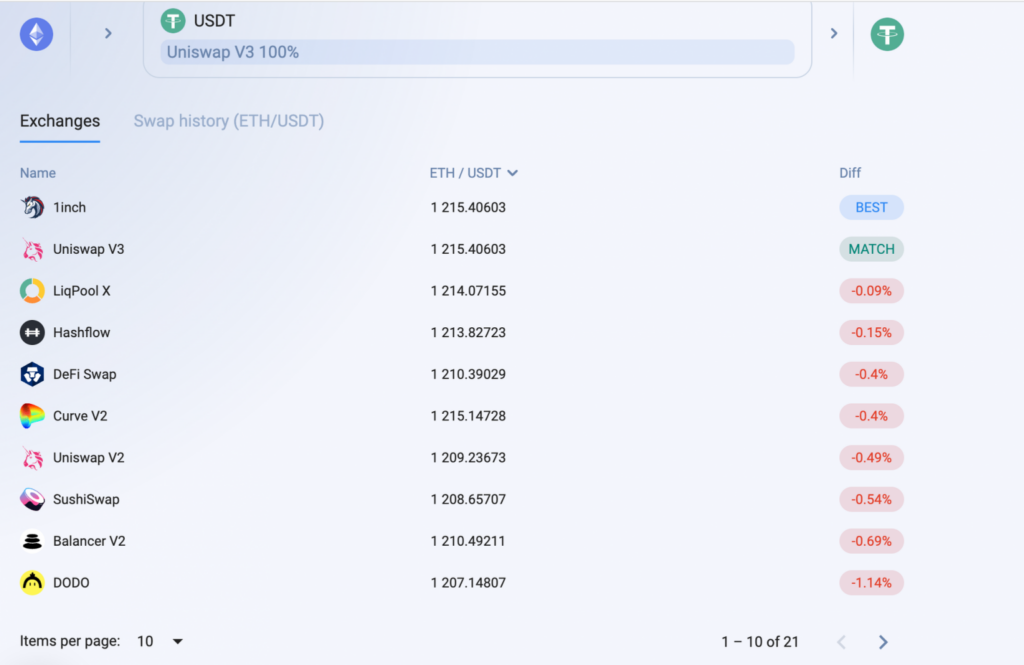

Step 2

You will see several DEXs showing the price of USDT you will receive for exchanging 1 ETH. It appears that DEX 1Inch and Uniswap have the same price. You can choose to swap ETH on 1Inch or Uniswap. For simplicity, you can directly swap ETH on 1Inch.

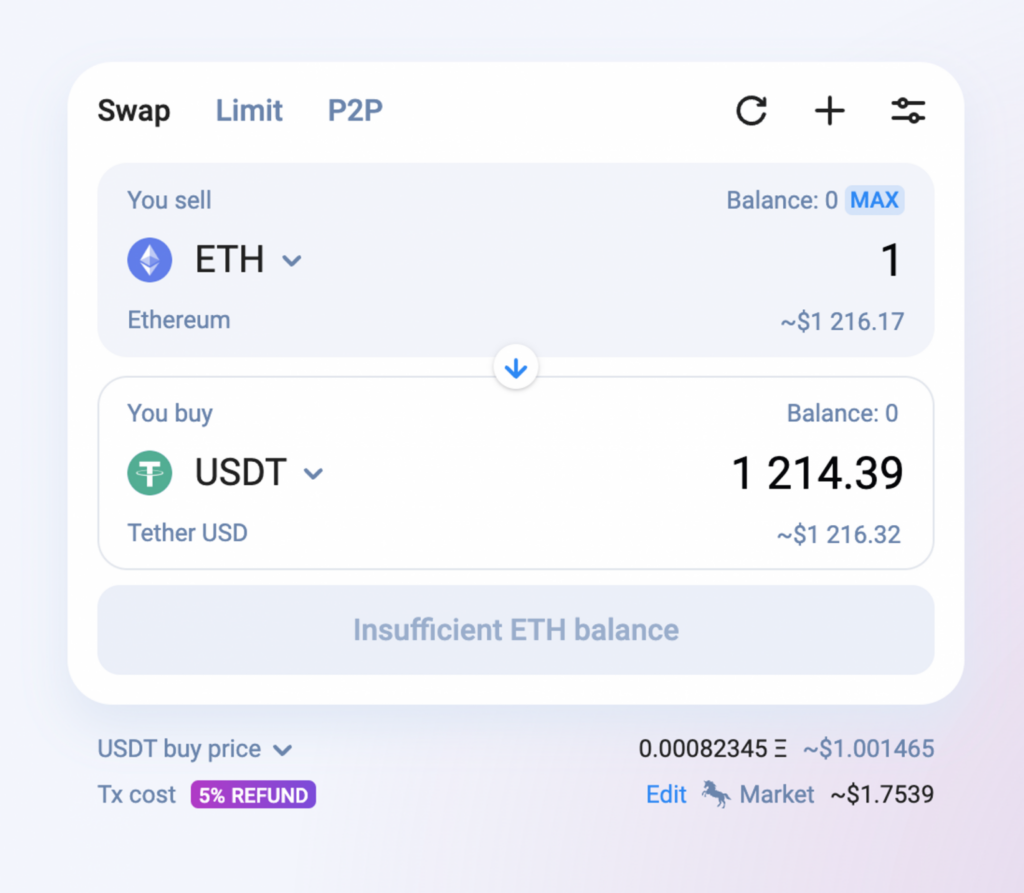

Step 3

Enter the amount of ETH you want to exchange. Then click “Swap.” After successfully swapping, the amount of ETH in your wallet will decrease, replaced by an increase in the amount of USDT.

Tips for Choosing DeFi Applications

After learning how to use DeFi applications and the services they offer, you can determine which DApps suit you best. Here are some steps you can take before choosing a DeFi application:

- Choose the blockchain on which the DApps are built. Some blockchains have robust DeFi ecosystems, such as Ethereum, Binance Coin, Solana, and others. This choice can also affect the gas fees incurred during transactions.

- Check the TVL (Total Value Locked) or the amount of funds available in the target DApps to assess asset liquidity. You can also check the amount of assets held by a DApp through its wallet address on a block explorer.

- For staking features, choose an APY (Annual Percentage Yield) that suits you. The higher the APY, the greater the potential rewards, but the risks are also higher.

- Check the project’s community through platforms like Telegram, Twitter, and Discord. An active community can be an indicator of a DeFi project’s sustainability.

- Finally, to gain more confidence, research the developers and the future plans of the DApp through available whitepapers and roadmaps.

Some Popular DeFi Applications

Uniswap (UNI)

Uniswap is one of the most popular decentralized exchanges (DEXs) on the Ethereum network. It operates using an Automated Market Maker (AMM) protocol.

With Uniswap, users can quickly and easily exchange crypto assets. Additionally, users can become liquidity providers by locking crypto assets in a liquidity pool.

Compound (COMP)

Compound is a widely used lending and borrowing DApp. With Compound, users can lend crypto assets by depositing them and receive rewards in the form of COMP tokens. Users can also borrow ERC-20 tokens by providing collateral first.

Aave (AAVE)

Aave is a money market application running on the Ethereum network. Aave has a primary token called AAVE. Users can lend and borrow crypto assets. Additionally, users can stake AAVE tokens to secure the network and earn rewards.

Synthetix (SNX)

Synthetix is a DEX that provides synthetic assets. This platform creates synthetic assets or “Synths,” which are tokens that resemble real assets. The goal is to give crypto investors exposure to assets that are not available on the blockchain, such as gold and silver. In short, Synths are a combination of cryptocurrency and derivative assets.

Available assets on Synthetix include cryptocurrencies, commodities (gold, silver, crude oil), fiat currencies, indices (NIKKEI, CEX, FTSE), and stocks (TSLA). These synthetic assets (Synths) will become sTokens, such as sBTC, sXAU, sUSD, sTSLA, and so on.

On Synthetix.io, users can buy, stake, and borrow synthetic assets.

What’s the Future of DeFi?

DeFi is often said to be the future of banking. DeFi is evolving with the capability to improve traditional financial systems. However, DeFi is still a high-risk financial service at present.

Some major institutions have gained direct exposure to crypto assets. In the last two years, several institutions have entered the DeFi ecosystem to develop their business models, such as Goldman Sachs, Barclays, Banco Santander, and Itau Unibanco. On November 2, 2022, JP Morgan even conducted a transaction using the DeFi application Aave on a public blockchain for the first time.

Despite its massive growth, the relatively new and developing DeFi space certainly faces several challenges. These include a lack of regulation, bugs in smart contracts, rug pulls, blockchain network disruptions, and other obstacles.

In the future, DeFi is expected to be further developed by various blockchains and to collaborate more with centralized financial institutions. Some US economists also believe that regulation is crucial for the sustainability of DeFi.

Conclusion

DeFi is not just a trend—it is a financial revolution. As traditional banking faces disruption, DeFi offers a more open, transparent, and efficient financial ecosystem. However, users must stay informed, manage risks, and conduct thorough research before participating in DeFi investments.

Learn more knowledge of crypto through various articles on Safubit Academy. All articles on Safubit Academy are created for educational and informational purposes only and are not intended as financial advice.

Don’t forget to follow our social media:

X : https://x.com/safubit

Medium : https://medium.com/@safubit.exchange

February 3, 2025

February 3, 2025