Master AMMs: The Disruptive Tech Powering DeFi Growth

An Automated Market Maker (AMM) is a decentralized trading system that uses algorithms to facilitate digital asset exchanges. Unlike traditional order book-based systems, AMMs rely on liquidity pools rather than direct buyer-seller matching.

The AMM mechanism is now the backbone of decentralized exchanges (DEXs), enabling users to swap crypto assets without intermediaries. Some of the most popular AMM-based platforms include Uniswap, Curve, and Balancer.

Article Summary

📠 Crypto AMM is a mechanism that uses computer algorithms to enable the automation of digital asset exchanges. AMMs utilize decentralized liquidity pools to allow users to buy and sell crypto assets without needing a third party to arrange transactions.

⚖️ AMM mechanisms are specifically designed for the trading of digital assets such as cryptocurrencies. AMMs facilitate decentralized and automated asset exchanges without the need for intermediaries monitoring an order book.

⛲ All crypto asset exchanges on DEX platforms using AMMs require liquidity pools. These serve as the source of liquidity for crypto asset pairs on a DEX and prevent high slippage. Liquidity providers are crucial to the AMM mechanism, supplying the asset pairs that can be traded.

🏦 AMM systems and the DEX platforms that use them have their respective advantages and disadvantages. These platforms are typically suitable if you want to invest in new and less popular crypto assets. However, you need to pay attention to the transaction volume and the depth of the liquidity pools to avoid slippage and transaction failures.

What is an Automated Market Maker (AMM)?

Automated Market Makers are mechanisms that use computer algorithms to enable the automation of digital asset exchanges. AMMs utilize decentralized liquidity pools to allow users to buy and sell crypto assets without needing a third party to arrange transactions.

Essentially, an AMM system is a program that automatically matches two parties wishing to exchange assets. Almost all decentralized crypto exchanges (DEXs) use the AMM system to facilitate trading on their platforms.

The automated market makers system can only be applied to blockchain networks with smart-contract capabilities, such as Ethereum and Binance. In an AMM system, anyone can become a liquidity provider as long as they meet the algorithm’s requirements. Some of the most popular AMMs are Uniswap, Balancer, and Curve.

How Does AMM Work?

The AMM mechanism is specifically designed for the trading of digital assets such as cryptocurrencies. AMMs enable decentralized and automated asset exchanges without the need for intermediaries monitoring an order book. This mechanism was first utilized by DeFi products such as DEXs. Uniswap, one of the earliest and most popular DEX platforms, first used the AMM mechanism to build large liquidity pools that could be used by many users.

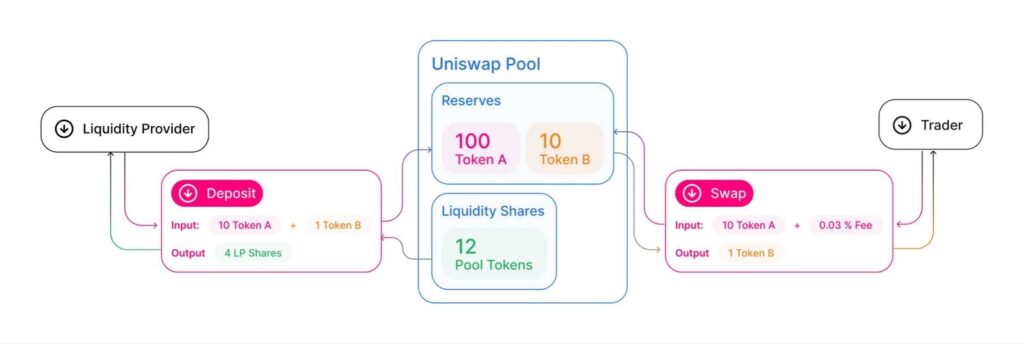

How automated market makers execute trades. Source: Shrimpy

The AMM algorithm regulates all aspects of asset exchanges through smart contracts. It displays constantly updated market prices and executes all trades. However, another critical component that determines the AMM mechanism is the liquidity pool and its providers.

One of the most important technical aspects of AMM is ensuring that a liquidity pool remains balanced so that the prices of all assets within it align with market prices. The AMM mechanism ensures this through mathematical calculations. Uniswap and the majority of DEXs use the formula x*y=k to maintain liquidity pool balance. X represents crypto asset A, and Y represents crypto asset B, while K is a constant value. Essentially, this formula always balances the value of assets A and B so that the total value of K remains the same.

Liquidity Pool

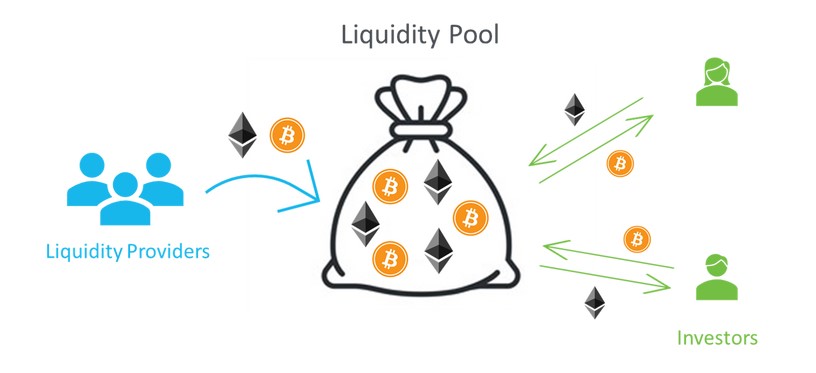

A liquidity pool contains various crypto assets that are deposited by users and withdrawn by other users. Source: Kesitys

A liquidity pool is a crucial pillar of the AMM system. All crypto asset exchanges on DEX platforms using AMMs require liquidity pools. They act as the source of liquidity for crypto asset pairs on a DEX and prevent high slippage. A liquidity pool is essentially a pool where all asset exchanges occur.

All exchanges occur by depositing and withdrawing assets from the pool. Those who provide assets to the pool for a certain period are called liquidity providers. Liquidity providers play a crucial role because the more assets stored in the pool, the smaller the slippage, reducing user losses.

DEXs want each asset pair (e.g., Bitcoin-FTM) to have deep liquidity so that users do not suffer losses. DEX platforms offer various incentives to encourage users to become liquidity providers. They incentivize liquidity providers by sharing a portion of the transaction fees collected by the platform.

Becoming a Liquidity Provider

As previously mentioned, liquidity providers are crucial to the AMM mechanism as they supply the crypto asset pairs that can be traded. Liquidity providers receive rewards determined by a DEX, such as a percentage of the transaction fees earned by the platform.

Additionally, some DEX platforms allow liquidity providers to engage in yield farming with their LP tokens. This allows them to earn additional financial gains from yield farming. Yield farming is a DeFi product where you lock your tokens to earn interest. Examples of DEXs using this scheme are PancakeSwap and SpookySwap.

However, there are risks to becoming a liquidity provider, especially if you provide liquidity on platforms with low transaction volumes and liquidity. You also need to understand the concept of impermanent loss. Impermanent loss is a temporary loss usually experienced by liquidity providers due to the price fluctuations of crypto assets in the liquidity pool. This concept is termed “impermanent” because you will not incur losses unless you withdraw assets from the liquidity pool. Therefore, you can wait until your asset value returns to avoid impermanent loss.

Advantages and Disadvantages of AMM on DEX Platforms

Advantages

💻 Decentralization: Automated market makers are decentralized systems that utilize smart contract programs to execute trades and other activities on DEXs. Some DEXs also have their own governance systems, allowing platform users to vote on various DEX policies such as transaction fee percentages and more.

⚡ Non-Custodial: All DEX platforms are non-custodial, meaning they do not store and hold your assets while you use their services. In centralized exchanges (CEXs), your assets are temporarily stored, and the exchange has the right to freeze assets if serious violations such as criminal acts occur.

🪙 More diverse crypto asset choices: DEXs are usually the first choice for launching various new crypto assets. Some DEXs even have dedicated sections for new or upcoming tokens. Therefore, they are suitable platforms if you want to invest in new and less popular crypto assets.

Disadvantages

🌊 Liquidity depth: All DEX platforms using AMM systems rely on liquidity providers to function optimally. A DEX requires significant liquidity so that all transactions can be processed quickly at appropriate market prices. If you use a DEX with too little liquidity, your transactions might not be processed or even fail.

💸 Transaction volume and slippage: DEX platforms also require stable transaction volumes to avoid high slippage levels. Using a DEX with low transaction volume will result in your purchase price differing from the actual market price.

🤑 Limited purchase types: Nowadays, major crypto exchanges can offer various types of purchases besides spot, such as limit orders, OCO, and stop limits. Unlike CEXs, most DEXs only support purchases at market prices or spot buys.

Some of the Most Popular AMM Protocols in Crypto

Some crypto asset applications that utilize the AMM mechanism. Source: Decentralized Finance.

Curve:

Curve is one of the most popular DeFi applications specifically created to build many liquidity pools. Curve has successfully attracted many users who want to become liquidity providers because it offers dynamic incentives. Curve is the largest AMM application with a TVL of $9.65 billion USD.

AAVE:

AAVE is a DeFi application for lending that utilizes the AMM system. It is the second-largest AMM application after Curve, with a TVL of $9.1 billion USD.

UniSwap:

UniSwap is a DEX platform on the Ethereum network. It is also one of the first DEXs to popularize the AMM system. Additionally, UniSwap is the largest DEX platform by TVL compared to others. UniSwap is the largest DEX application with a TVL of $5.89 billion USD.

Balancer:

Balancer is a DeFi application that acts as an asset manager using smart contracts. This protocol uses AMM for all trading and swapping activities on its platform. Balancer’s TVL is $2.01 billion USD.

Final Thoughts on AMMs

Automated Market Makers (AMMs) have revolutionized crypto trading by eliminating intermediaries and improving market efficiency. By using smart contracts and liquidity pools, AMMs allow traders to swap assets in a decentralized and permissionless manner.

While AMMs offer incredible opportunities, users must understand the risks of liquidity provision and impermanent loss before engaging. With DeFi continuously evolving, AMMs are expected to become even more efficient, scalable, and widely adopted in the future.

Learn more knowledge of crypto through various articles on Safubit Academy. All articles on Safubit Academy are created for educational and informational purposes only and are not intended as financial advice.

Don’t forget to follow our social media:

X : https://x.com/safubit

Medium : https://medium.com/@safubit.exchange

February 5, 2025

February 5, 2025