What is DeFi? How It’s Revolutionizing Money

Decentralized Finance, abbreviated as DeFi, is often described as a technology that will revolutionize the financial industry. This is because, whereas we previously relied heavily on conventional banks to store funds and facilitate financial transactions, DeFi allows us to manage and execute these functions independently, without the need for third parties or centralized institutions.

For example, just as we save money in a bank, we can also deposit our crypto assets on DeFi platforms and earn interest on those deposits. The difference is that assets stored in DeFi are fully under our control as they are not entrusted to a third party, unlike when we save money in a bank.

So, how does DeFi work, and what are some examples of its services? Read on to learn more about DeFi and how to maximize your crypto assets.

Article Summary

🔗 What is DeFi? DeFi is a blockchain-based financial application ecosystem that operates without central authorities like banks or other financial institutions.

👨💻 Previously, financial services relied on institutions like banks to act as intermediaries; with DeFi, intermediary functions are handled by code written into smart contracts.

💵 With DeFi, the cost of using financial services is significantly reduced, ultimately opening doors for all layers of society to benefit from financial services.

Understanding DeFi

Decentralized Finance, or DeFi, is a blockchain-based financial application ecosystem that operates without central authorities like banks or other financial institutions.

Currently, nearly every financial service, including savings, lending, insurance, and stock markets, is still managed by centralized systems. This means that we need to have a bank account or access to a financial institution to use various financial products and services.

With the advent of Bitcoin’s blockchain technology, people can now transfer assets globally without needing a bank account. What if blockchain technology were used to build various decentralized financial services that go beyond just sending and receiving crypto assets? This is where DeFi’s development plays a crucial role.

How Does DeFi Work?

The development of DeFi applications essentially began with the invention of Ethereum’s blockchain and its smart contract technology. A smart contract is a computer program written on the Ethereum blockchain.

When a specific condition in the program is met, the smart contract automatically executes the programmed instructions, whether it is for transferring tokens between Ethereum addresses or performing other types of transactions.

With smart contract technology, the Ethereum blockchain enables more complex programming, giving developers the freedom to experiment with their own code and create applications known as Decentralized Applications (DApps). DeFi is essentially DApps focused on decentralizing traditional financial services.

While traditional financial services rely on institutions like banks as intermediaries, DeFi uses code written in smart contracts to handle all transaction processes. DeFi applications’ code is generally transparent and open-source, allowing users to verify the application’s code themselves. This means users can have full control over their funds.

Many DeFi applications are available today, offering services such as depositing crypto assets to earn interest, taking out loans, and more.

What Are the Benefits of DeFi?

The main advantage of the DeFi ecosystem is the ease of access for everyone to utilize any financial service. Traditional financial systems rely on intermediaries like banks, which aim to generate profit.

This causes financial services to not always be accessible to all layers of society, particularly low-income individuals. DeFi reduces the cost of using financial services significantly, eventually opening doors for all layers of society to benefit from financial services.

DeFi applications essentially drive financial inclusion, a condition that allows everyone to access financial products or services. Financial inclusion has been proven to help people escape poverty, reduce social inequalities, and stimulate economic growth.

What Are Some Examples of DeFi Applications?

The rapid development of DeFi is quite intriguing. To understand more about what DeFi is and how its technology is widely used today, here are some examples:

DEXs

Decentralized exchanges (DEXs) are applications that facilitate the exchange of one token for another using smart contract technology. One example of a popular DEX built on Ethereum is Uniswap and Sushiswap.

With DEXs, you can exchange ETH for ERC-20 tokens or vice versa, and also exchange between ERC-20 tokens. Any token can be exchanged as long as it adheres to the ERC-20 standard.

DEXs also exist on blockchains other than Ethereum, such as PancakeSwap. This application is built on the Binance Smart Chain with BNB (Binance Coin) as its currency. Similar to Uniswap, PancakeSwap allows users to exchange crypto assets.

Crypto Lending and Borrowing

One popular DeFi application today is AAVE and Compound, blockchain-based lending and borrowing platforms built on Ethereum. With AAVE and Compound, you can deposit crypto assets to earn interest and also borrow other crypto assets.

To use these applications, you only need an Ethereum wallet and some funds in the form of ETH or ERC-20 tokens. With AAVE or Compound, anyone can lend and borrow assets without a bank or other financial institution.

Asset Management

One currently popular DeFi application is Yearn Finance. Launched in early 2020, Yearn Finance is a yield aggregator application based on the Ethereum blockchain, designed to generate returns or interest from the crypto assets invested by its users.

Users can deposit an asset into a Yearn Finance vault, and each vault uses various strategies to generate interest from the deposited assets.

How to Start Using DeFi?

First, you need an Ethereum wallet that can interact with dApps. One commonly used wallet is MetaMask.

Second, you need to have enough ETH in that wallet to perform transactions on the DeFi protocols you want to use. Most DeFi protocols are built on the Ethereum blockchain, so you need to buy ETH or ERC-20 coins to use them. However, as mentioned above, there are many DeFi applications using the Binance Smart Chain, which uses BNB as its currency.

Finally, be sure to study the application you want to use before purchasing tokens and performing transactions on the platform. Once you’ve made your choice, you can start buying your preferred crypto assets

The Evolution of DeFi

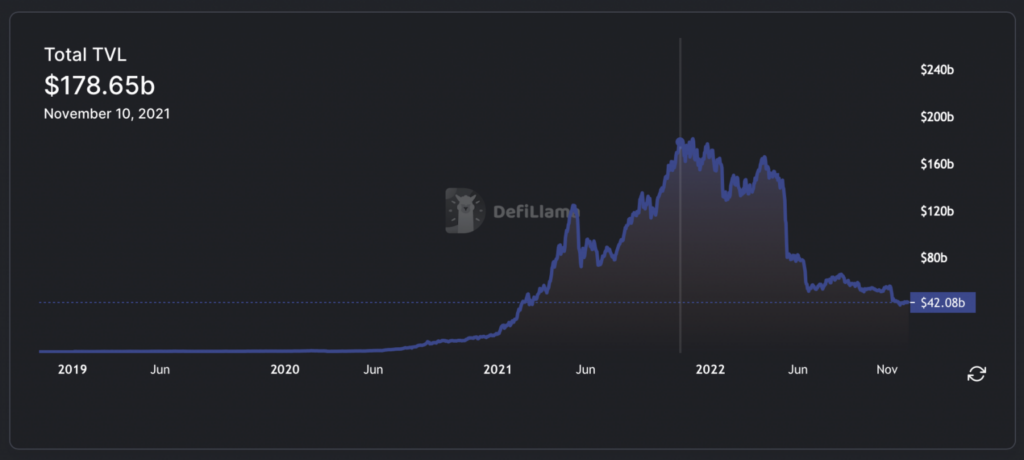

Source: Defillama

DeFi use began to gain popularity in 2017, but it surged rapidly in 2021 – 2022. As of June 2021, the total value locked (TVL) in DeFi smart contracts exceeded $124.25 billion. By November 2022, the TVL in DeFi projects had reached $181.3 billion.

However, as seen in the graph above, TVL in DeFi projects dropped sharply since May 2022, following the de-pegging of the UST token, an algorithmic stablecoin from Terra, the second-largest DeFi ecosystem after Ethereum. This event affected public confidence in DeFi and the crypto industry as a whole, especially amidst a prolonged bear market.

Nevertheless, according to data from DappRadar, TVL in DeFi projects began to show signs of recovery in Q3 2022, with a 2.9% increase compared to Q2 2022 figures.

The Future of DeFi

The future of DeFi depends on how well this technology can be implemented and accepted by society. Many people are optimistic about DeFi’s potential to change how we think about finance and create more opportunities for individuals and small businesses. However, DeFi also faces challenges, such as security and regulatory issues, which must be addressed for the technology to grow and develop substantially in the future.

Learn more knowledge of crypto through various articles on Safubit Academy. All articles on Safubit Academy are created for educational and informational purposes only and are not intended as financial advice.

Don’t forget to follow our social media:

X : https://x.com/safubit

Medium : https://medium.com/@safubit.exchange

February 10, 2025

February 10, 2025