How to Mine Bitcoin: Process and Advantages

Many individuals attempt to gain Bitcoin through mining, a process that involves verifying transactions and adding new blocks to the Bitcoin blockchain by solving complex mathematical puzzles. However, as the Bitcoin network expands and competition intensifies, the profitability of mining has become increasingly challenging. Additionally, the costs associated with mining equipment and operational expenses are substantial. Is Bitcoin mining still a lucrative endeavor today? Let’s explore the details in this article.

Article Summary

Bitcoin mining involves verifying transactions and adding new blocks to the blockchain, which also generates new Bitcoins.

To start mining, one needs an ASIC mining device, electricity setup, and suitable mining software.

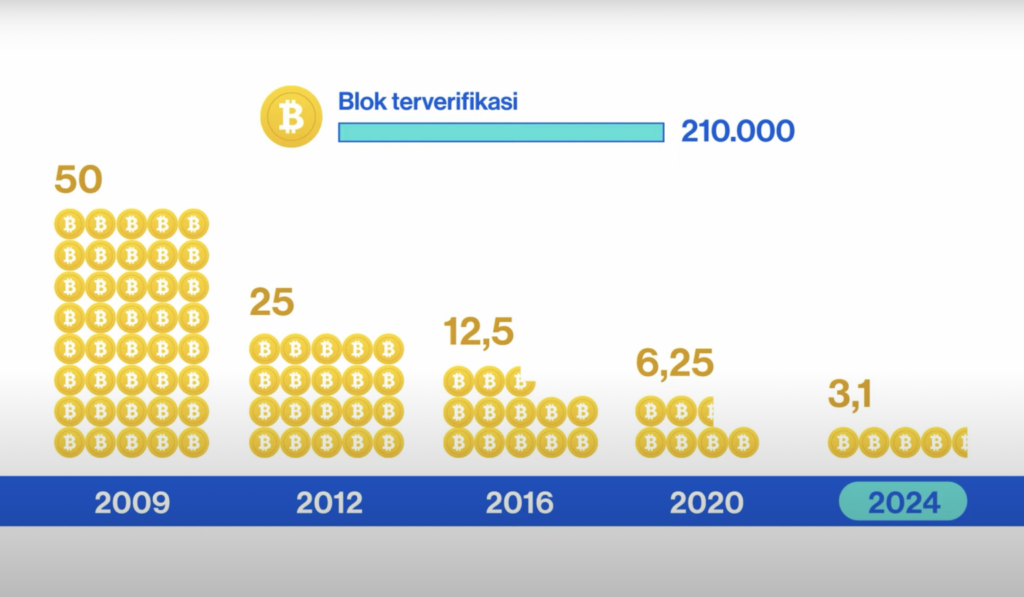

Mining rewards are currently 6.25 BTC per block (from 2020 to 2023), decreasing approximately every four years through a process known as Bitcoin Halving to maintain Bitcoin’s scarcity.

Other minable crypto assets include LTC, ETC, DOGE, BCH, DASH, KDA, and ZEC, offering alternative mining opportunities.

Understanding Bitcoin Mining

Bitcoin mining is the process of verifying and adding blocks containing Bitcoin transactions to the blockchain by solving mathematical puzzles. This process is called mining because through validating transactions and adding new blocks to the blockchain, new Bitcoins are issued.

Just like mining commodities such as gold or precious stones that require labor and effort, Bitcoin mining also requires significant computational power. To validate Bitcoin transactions, miners must compete to solve mathematical puzzles using sophisticated computers known as Application-Specific Integrated Circuits (ASICs).

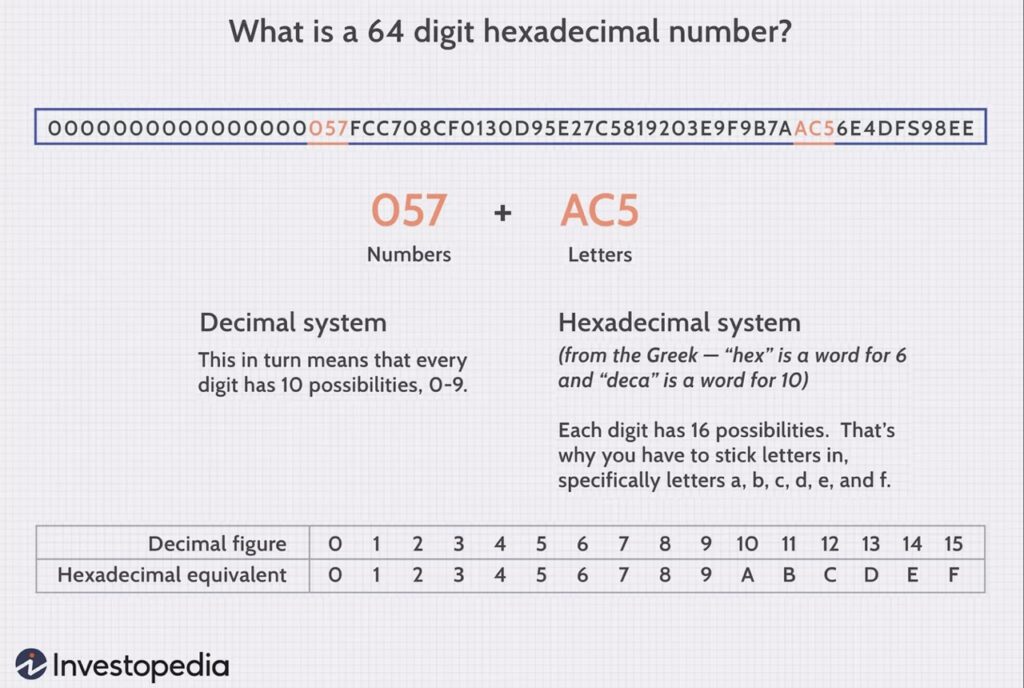

In more detail, in validating these transactions, miners must solve puzzles containing a 64-digit hexadecimal code or hash. Here is an example of a 64-digit hexadecimal hash: The newest or most recent block on the blockchain has a hash or alphanumeric code processed from the previous block. Each hash in one block refers to the hash in the previous block, and so on, creating an interconnected chain.

Data within the interconnected blocks cannot be changed, as altering data would change all subsequent hashes. This is why it is called a blockchain and why the system is secure and difficult to hack. This verification process prevents “double spending,” where the same Bitcoin is used for different transactions.

The mechanism of transaction verification requiring miners to solve mathematical puzzles is also known as proof-of-work (PoW). Besides Bitcoin, other crypto assets that use the PoW consensus mechanism include LTC, ETC, DOGE, BCH, DASH, KDA, ZEC.

Proof of Work Mechanism

As mentioned earlier, PoW is a consensus mechanism used by Bitcoin. PoW itself is a mechanism that regulates the process of adding transaction blocks to the blockchain. The use of the PoW mechanism is inseparable from the decentralized and peer-to-peer nature of the blockchain network, requiring a way to reach consensus while maintaining security.

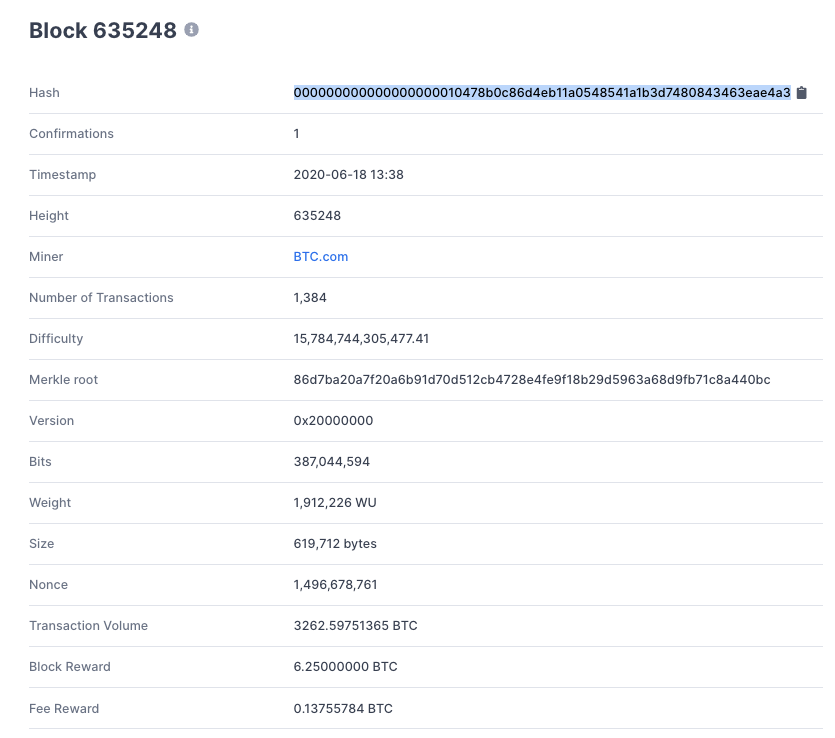

In the PoW system, all transactions are processed and verified by miners. Each miner competes to solve cryptographic puzzles and upload blocks to the blockchain. For a block to be valid, the SHA-256 hash of the block must be lower than the current difficulty level. To ensure the hash is lower than the target, a number called a nonce (number used for once) is added to the block.

An example of a valid block where the hash has many leading zeros

When a hash is declared valid, a new block is added to the blockchain. Miners who guess the target hash correctly receive a reward of coinbase + transaction fees. The entire process of mining one block takes about 10 minutes. The PoW mechanism is known for its excellent security and decentralization compared to other consensus mechanisms. This is because to hack the blockchain, the hacker must control 51% of the total hashing power, which is very difficult due to the computational power required to control such a large network. However, on the other hand, PoW requires significant energy, making this mechanism considered environmentally unfriendly.

Bitcoin Mining Process

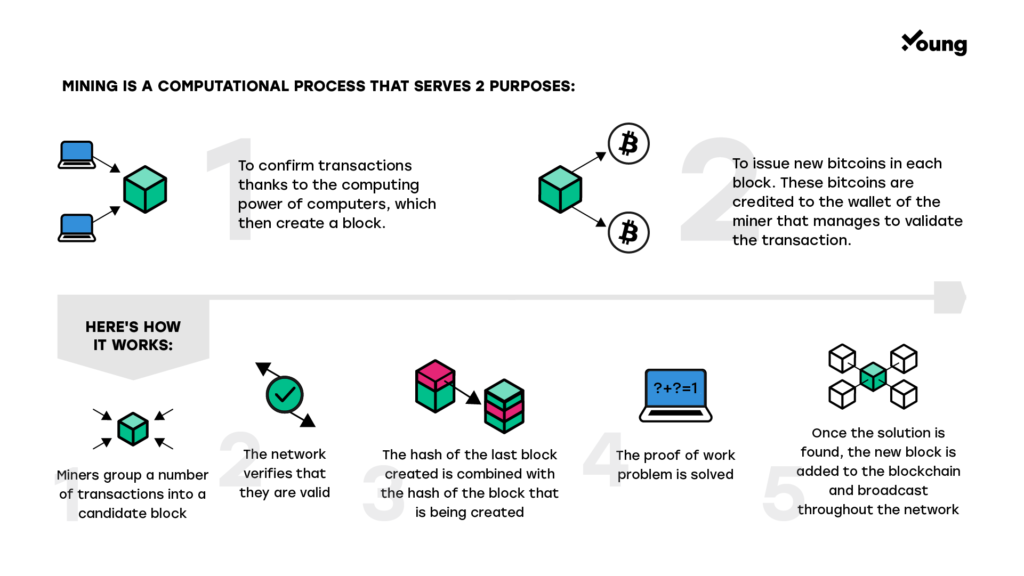

Bitcoin Mining Process. Source: Young Platform

The Bitcoin mining process begins when a Bitcoin transaction needs to be validated. As previously explained, this validation process will produce a new block added to the Bitcoin blockchain. When each new block is mined, a series of new hashes or target hashes appear.

To guess the target hash, ASIC devices perform computations to generate numbers matching the target hash. Miners compete to be the first to get the correct answer or the closest series of numbers to the target hash. Unfortunately, guessing the hash is not easy.

Moreover, with the increasing number of miners participating in Bitcoin mining. The more miners join the mining network, the higher the mining difficulty. Therefore, advanced devices like ASICs with high hash rates are needed. The higher the hash rate of a device, the greater the chance of successfully guessing the target hash.

When a miner successfully guesses the target hash and completes a Bitcoin block, they receive a reward of 6.25 BTC. With BTC priced at $19,350 at the time of writing, the reward is $120,938 (6.25 x 19,350) or around 1.88 billion rupiahs. With such a fantastic figure, it’s not surprising that many people try their luck with Bitcoin mining.

Bitcoin Halving reduces mining rewards every four years to maintain the increasing value of BTC

As a note, with the halving system, approximately every four years, the reward from Bitcoin mining is halved. When Bitcoin was first launched in 2009, the mining reward was 50 BTC. Then, on halving day in 2012, it was halved to 25 BTC. In 2016, it became 12.5 BTC, and in 2020, it was halved again to 6.25 BTC. Therefore, on the next halving day in 2024, the Bitcoin mining reward will be 3.125 BTC. This halving process will continue until 2140, or when the total supply of 21 million Bitcoins has entered circulation.

How Long Can Bitcoin Be Mined?

As we know, Bitcoin is designed with a controlled supply principle, where only 21 million coins can be mined and circulated in the market. This Bitcoin mining process will continue until around 2140 or until all 21 million coins are in circulation. So, what will happen when all Bitcoins are mined in 2140?

Satoshi Nakamoto predicted this and wrote in the Bitcoin Whitepaper that once the predetermined number of coins is in circulation, the incentive can shift entirely to transaction fees.

Currently, mining rewards are divided into two types: transaction fees paid by Bitcoin owners who transact and rewards in the form of new Bitcoins. This means that after the 64th halving day in 2140, there will be no new Bitcoin rewards, as all Bitcoins will be in circulation.

Eventually, miners will only serve as transaction validators. Therefore, miners’ rewards will only be in the form of transaction fees paid by Bitcoin owners who transact.

The last Bitcoin halving will occur in the year 2140

So, will the mining process, which is only validating transactions, remain profitable? This is challenging to answer, especially since 2140 is still very far away, making it difficult to predict future developments. However, one thing we know is that if Bitcoin prices rise, transaction fees will also increase.

Preparation and How to Mine Crypto:

Before mining crypto, miners must prepare several things.

Preparing Hardware (Mining Rig)

In the early stages of crypto asset development, you could mine using a laptop or PC. However, as the blockchain network and the crypto asset ecosystem grow, simple computers can no longer be used. Today, to mine Bitcoin and other crypto assets, you need at least an Application-Specific Integrated Circuit (ASIC).

ASIC Mining Rig used for mining Bitcoin. Source: HWP

ASICs are superior for crypto mining because they can generate more than one trillion random codes per second, exponentially more guesses than any regular laptop can produce per second. Thus, using ASICs increases the chances of successful Bitcoin mining.

Unfortunately, ASIC devices are quite expensive. According to ASIC Miner Value, the most profitable ASIC device, the Antminer KA3, is currently priced at around $12,000. So, for those planning to mine Bitcoin, be prepared to spend a lot.

Preparing an Energy Source

Besides expensive ASIC devices, Bitcoin mining requires substantial electricity. With ASIC devices continuously operating for mining, and each device having a significant power capacity, electricity needs are also substantial.

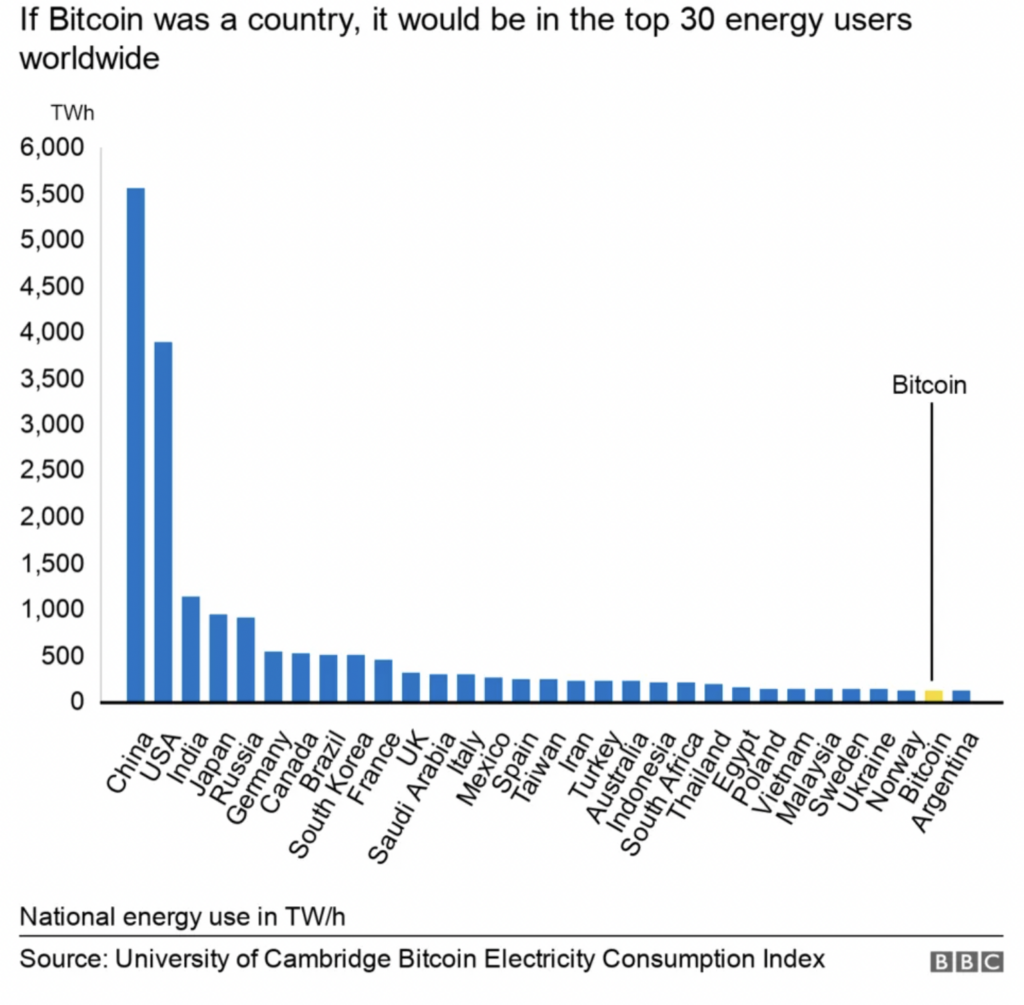

Bitcoin mining activity has a relatively high energy consumption. Source: BBC

For example, one Antminer KA3 device requires about $272 in electricity costs per month. To increase the chances of successful Bitcoin mining, more ASIC devices are needed, resulting in higher monthly electricity bills.

Therefore, many miners or mining pools are located in countries with relatively low electricity costs to reduce Bitcoin mining operational costs. Additionally, using renewable energy sources like solar energy is also done to make Bitcoin mining activities more environmentally friendly.

Choosing Software

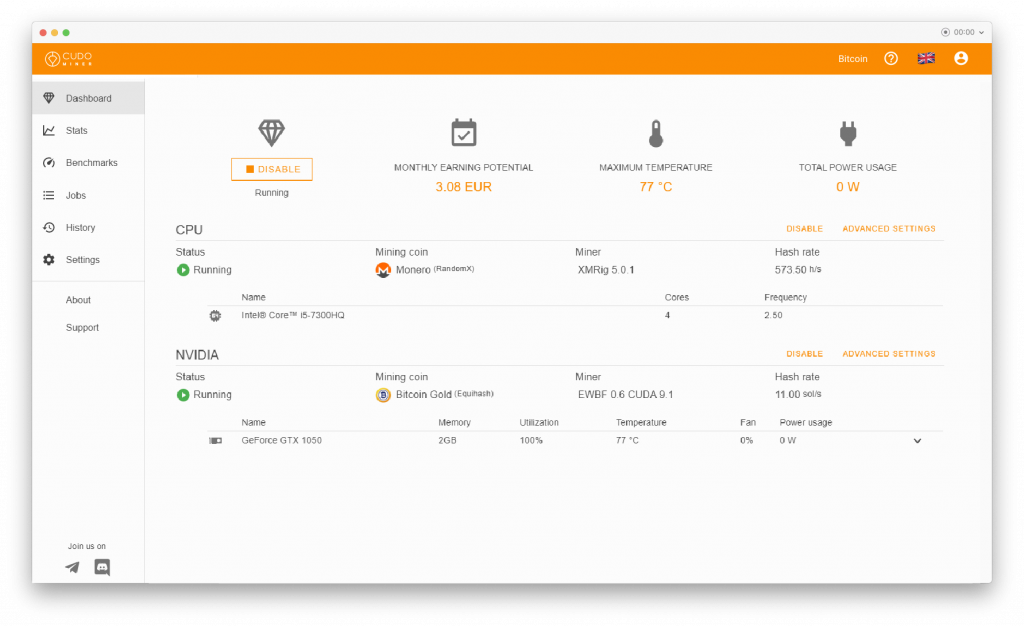

After preparing hardware, the next step is to prepare software that allows you to mine Bitcoin. The main function of this software is to connect your device to the blockchain network, helping you monitor and control the device. Moreover, this software collects mining results and distributes them across the Bitcoin network.

Each software has its advantages, disadvantages, and characteristics, making choosing mining software based on individual needs essential. For instance, some software is suitable for beginners due to its practical interface, while others offer various features, making them more suitable for experts.

One of the Bitcoin mining software interfaces. Source: Cudo Miner

Unlike hardware, which requires significant investment, mining software can be obtained for free. However, ensure to Do Your Own Research (DYOR) before choosing Bitcoin mining software. Some popular mining software includes CGMiner, ECOS, EasyMiner, Kryptex Miner, Awesome Miner, Pionex, BFGminer, and Multi Miner.

How to Mine Bitcoin

When mining Bitcoin or other crypto assets, there are various methods you can choose based on your capabilities.

Solo Mining

As the name suggests, solo mining is a method where you mine alone. In other words, you need to purchase the necessary ASIC equipment, join the blockchain network as a node, download and install the required software, and try to mine Bitcoin independently.

Given the current state of the crypto asset ecosystem, solo mining is quite challenging. Especially with the current difficulty level of Bitcoin, the chances of winning the hash guess are one in 10 trillion. Even with high-end ASIC equipment, the likelihood of success is still very small.

Pooled Mining

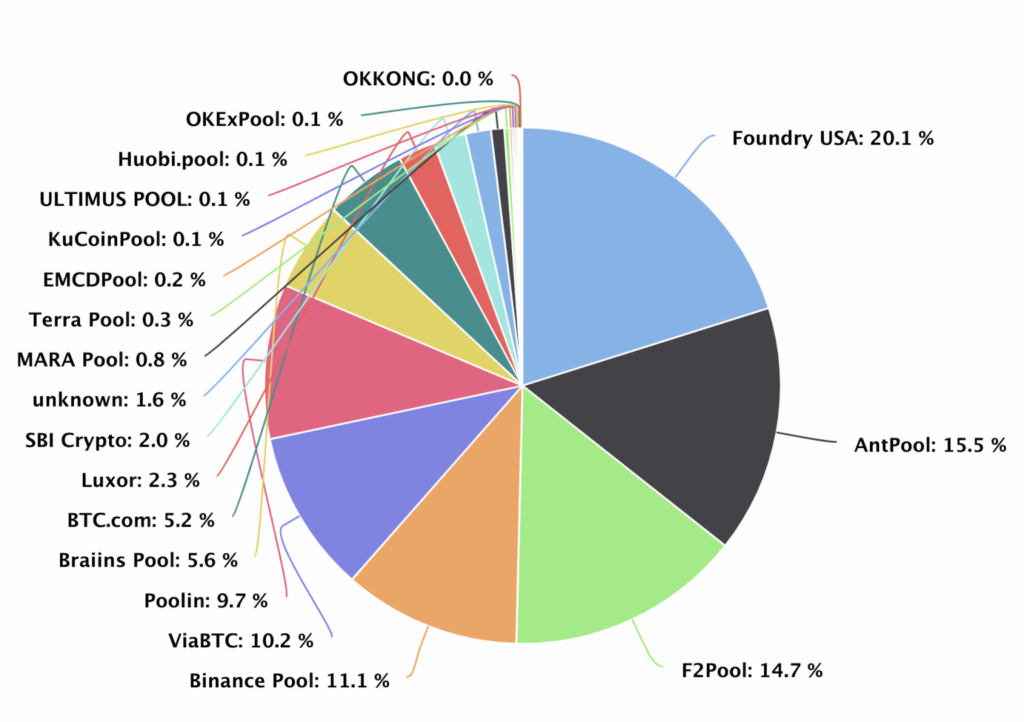

When solo mining Bitcoin becomes too difficult, joining other miners can be a viable option. This is what mining pools offer. A mining pool is a large group of miners who combine their ASIC power to increase the chances of solving a new block on a network.

When a new block is successfully solved by one of the members of the mining pool, the reward is shared among all members. However, the amount of the reward is adjusted according to each member’s hash power contribution. A good mining pool can make your Bitcoin mining more profitable, even if your ASIC equipment is not the best among others.

Distribution share of mining pools in the past year. Source: Btc.com

Although the results from a mining pool are much smaller compared to solo mining, this method can be far more profitable. This aligns with the higher likelihood of successfully solving a new block compared to solo mining. Furthermore, even though the rewards obtained are smaller, at least a mining pool can offer greater and more consistent chances of winning than solo mining.

Cloud Mining

If solo mining and pooled mining require you to have ASIC equipment and pay monthly electricity costs, cloud mining allows you to mine Bitcoin without preparing these two things. Through cloud mining, you can rent special computing power from cloud mining companies around the world.

Cloud mining companies will charge monthly or annual fees so you can use their equipment. These companies will carry out the mining process, and you only need to sit back. Any rewards obtained will be directly distributed to the renters.

This mining model sounds very attractive and practical, but there are also many scams that pose as cloud mining platforms. Therefore, make sure to research the fees, company background, and other important details first. Some of the largest cloud mining providers serving retail customers include Genesis and Bit Deer.

Other Crypto Assets That Can Be Mined

Currently, Bitcoin is the most popular crypto asset for mining. However, with Bitcoin having a very high difficulty level and intense competition, many miners reconsider mining this coin. Meanwhile, Ethereum, which previously used a proof-of-work mechanism, has just switched to proof-of-stake (PoS), so ETH can no longer be mined.

Therefore, miners are starting to look for alternative coins to mine. Some smaller tokens, which have relatively low competition among miners, might be an option. However, these smaller tokens are more volatile, making it harder to predict the profits obtained.

Furthermore, in terms of profitability, the profits obtained from mining smaller tokens are much smaller than Bitcoin. According to WhatToMine, some small tokens can provide a profit of USD 2-3 per day. Although this figure is not a large profit, at least you can get tokens for “free”. Moreover, there is a possibility that these tokens’ values will increase in the future. The equipment used to mine small tokens also does not require very advanced computers.

For those who want to choose tokens to mine, it is advisable to consider the following factors:

- The number of crypto exchanges that trade the crypto asset

- Ensuring the legitimacy and quality of the crypto asset to be mined

- Evaluating the durability of the equipment for long-term mining

- The possibility of withdrawing the crypto asset in fiat currency

Final Thoughts

Bitcoin mining is a high-risk, high-reward endeavor requiring significant investment, technical knowledge, and operational efficiency. While mining is still profitable under the right conditions, alternative investment options like crypto trading may offer simpler and more accessible ways to earn from digital assets.

For those interested in crypto investment without the complexities of mining, Safubit provides a secure, regulated, and user-friendly platform to buy, sell, and trade cryptocurrencies with ease.

Learn more knowledge of crypto through various articles on Safubit Academy. All articles on Safubit Academy are created for educational and informational purposes only and are not intended as financial advice.

Don’t forget to follow our social media:

X : https://x.com/safubit

Medium : https://medium.com/@safubit.exchange

February 4, 2025

February 4, 2025